You must confirm your income of the submission the mandatory payslips and you may lender comments

Income This consists of your very first yearly earnings or other sourced elements of fund, such as overtime income, guaranteed extra repayments, earnings, or income out-of freelance really works. What’s more, it facts inside earnings of investments and pensions, together with financial fix and you may child support of an ex lover-companion.

Outbound Repayments and you may Complete Expense Lenders directly comment your normal monthly obligations. Which factors within the many techniques from lease, resources, portable costs, personal credit card debt, college loans, cost of living, an such like. Tough, whether your membership is in overdraft, the bank makes you save money money than just you currently have. Becoming secure, get funds in check at the very least six months before applying for a home loan.

Fret Try: Change One to Impression Your bank account This calls for simulating circumstances you to definitely obstruct your finances. Rising rates and higher monthly premiums tend to significantly apply to your own capability to pay off. It tests products particularly employment losings, incapacity to be effective on account of disease, or if perhaps your lady lost their job. It testing to have radical lifestyle change, for example expecting or taking a break from the job.

To guard your self regarding unexpected monetary trouble, it is very important create large offers if you can. For folks who experience redundancy otherwise issues, you will have a reputable financial safety net. This would wave your over right until you could recover your bank account. They ensures you can afford timely mortgage payments to cease defaulting on your own loan.

- Payslips on the last 3 months

- Financial comments on last half a year three years

- Driver’s license otherwise passport getting identity

- P60 form from your own manager

- Invoices out of power bills

- SA203 while you are mind-working or you has almost every other earnings offer

When you find yourself notice-employed, assume lenders to ask for additional files. Needed proof income, for example a statement from your accountant layer 2-3 several years of your levels.

If your membership stability is actually shorter so you can no prior to pay day, it’s thought a warning sign

Besides getting a formal financial app, don’t forget to make an application for home financing contract in principle (AIP). Also known as a mortgage promise otherwise a choice concept, its a file off a lender claiming the particular matter it are able to grant in your home loan. If you are an AIP doesn’t obligate a loan provider, it gives sensible how much you might borrow. Knowing the precise matter, you can begin seeking residential property that are in this one to rate variety.

AIPs only require a silky browse your credit reports, which means it doesn’t perception your credit rating. At the same time, providing a formal home loan application requires a difficult search on your own credit file. Of a lot realtors and suppliers constantly ask for a keen AIP. They think it over a sign of a serious homebuyer.

It’s best to end these scenarios to protect your own personal credit record

How much cash can you use? Lenders about U.K. basically lend between 3 to 4.5 times an individual’s yearly money. Such as, in case the yearly earnings was ?fifty,000, which means a lender may grant your up to ?150,000 in order to ?225,000 having a home loan.

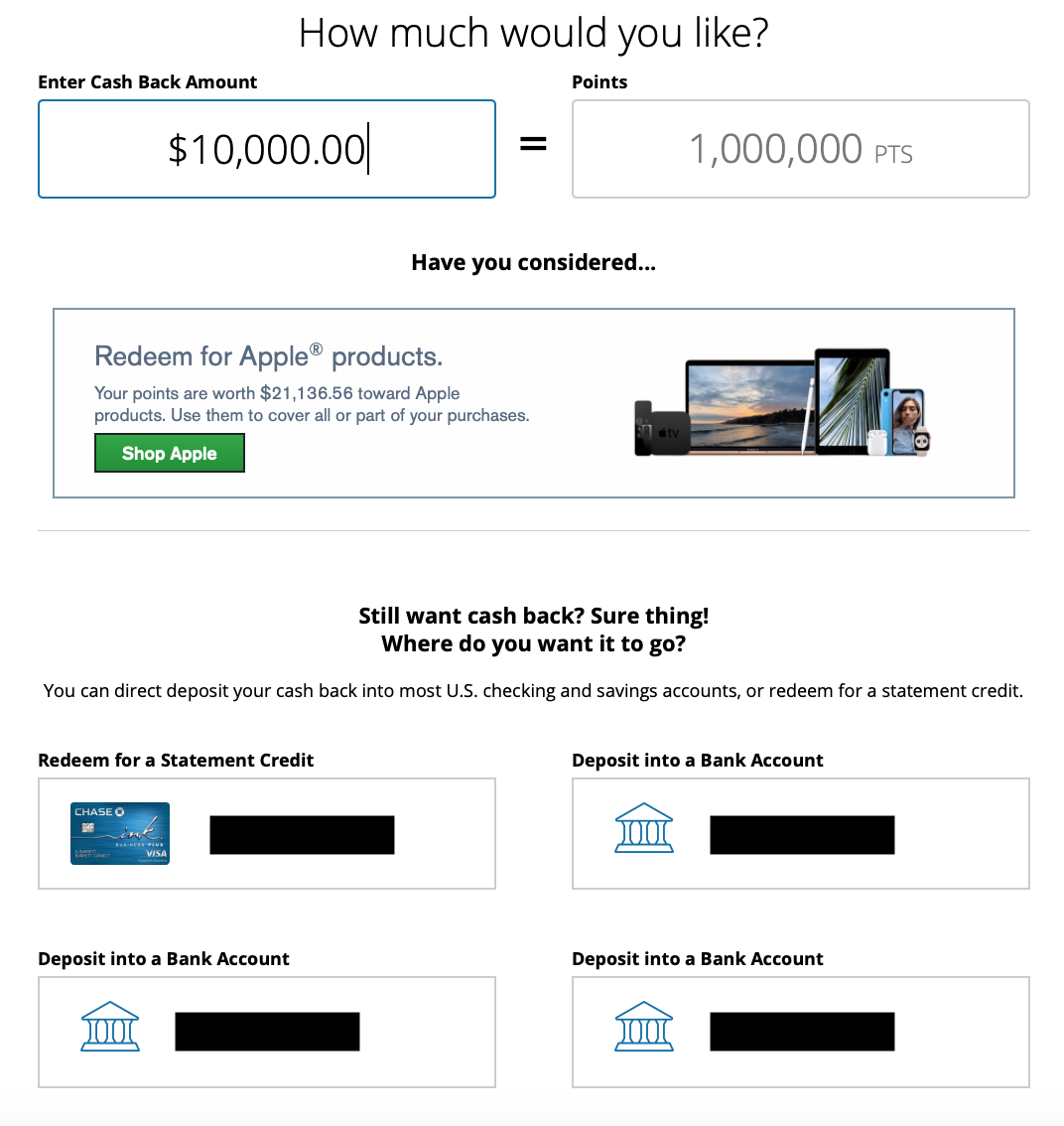

You can utilize the above mentioned calculator to help you guess how much you can obtain based on their paycheck. You may want to enter in your partner’s income if you intend to help you get a mutual application into home loan. Let’s think you and your partner keeps a blended overall annual income regarding ?102,two hundred. Comprehend the analogy less than.

Considering all of our calculator, for folks who sign up for a home loan along with your mate, a loan provider ount ranging from ?211,600 in order to ?306,600. Observe that this perhaps not a proper imagine. The actual number will still depend on personal loans DE low creidt their cost assessment, hence ratings your own credit suggestions.