What are the differences between active and you can apartment-price repair deductions?

- To own income tax objectives, a big difference is made between well worth-preserving costs and cost-boosting opportunities.

- Value-retaining repair strategies instance home ree ways while the energy-protecting investments, but well worth-boosting design procedures for instance the inclusion from a great conservatory is actually maybe not.

- Cantons keeps additional listings away from tax-deductible costs. You could have the related factsheet from your own canton.

- You reach choose the extremely useful alternative: you can subtract either the fresh productive costs or a lump sum.

- You could claim the expense out of an extensive opportunity renovation once the income tax reductions over a period of 10 years. In the most common cantons, the primary factor is the invoice go out. In other people, it will be the big date out of commission that matters.

- Towards conclusion

Renovating property or flat takes care of twice more: as well as feeling way more at your home on your own assets, you will spend less https://paydayloancolorado.net/columbine/ income tax. This is because maintenance costs for your residence will likely be deducted of their taxes. And therefore costs qualify and and this dont?

And this repair costs are allowable?

Renovating a vintage home heating system otherwise bathroom is a thing that really needs as over most of the very long time. Which work is needed to maintain the value of the house. If it’s not achieved, this building manages to lose well worth or be away from restricted usability. These kind of expenses also are referred to as repair costs. They reduce the imputed rental value you only pay income tax towards.

Value-increasing expenditures is actually to own developments, deluxe fittings and you may extensions, such an alternate conservatory. Even though this type of costs count due to the fact financing will set you back and can slow down the amount of a home capital progress tax due if you decide to market the house subsequently, they can not feel deducted right from your nonexempt earnings.

Although not, if you renovate otherwise repair these aspects of your property within another day, these coming expenses could well be considered preserving their well worth, at which point you could potentially subtract all of them out of your tax. You will find you to definitely crucial difference: expenditures which help to keep time and cover the environmental surroundings can be constantly become subtracted.

Worthy of maintenance or worthy of improvement

Value-retaining opportunities mostly is normal measures for the repair and you can resolve of your strengthening as well as surroundings. The brand new substitute for of current factors having equivalent products (elizabeth.grams. a warming) also serves to preserve value.

Value-retaining restoration performs cannot alter the construction or function of the house. It has to get frequent just after a specific months. It is safe to assume you to a house will have to end up being refurbished several times during the its lifetime, and solutions are needed on a daily basis. Examples include:

- Bathroom otherwise kitchen home improvements, focus on new facade

- Solutions (including when tradesmen color, plaster otherwise wallpaper wall space, or carry out plumbing system, hygienic or carpentry works)

- Replacement for otherwise resolve of creating characteristics and you will home equipment (e.grams. a washer, ice box otherwise dish washer)

Costs that lead in order to a long-term escalation in the value of the house do not form fix costs, but they are regarded as worth-increasing financial investments. For many who setup a sauna, pick more sophisticated appliances or toilet, complement the actual basements or expand the fresh attic, your house will be from a higher standard throughout the much time identity. It might be top furnished and therefore more valuable than before. This is the property value the fresh replaced function that is compared, maybe not the worth of the property overall.

The second analogy can be utilized given that the basics of assist you decide in the event your expenses is preserving or growing worthy of: Remodeling your bathroom on sixties because of the substitution the outdated bathtub with a brand new a person is likely to meet the requirements as a regard-retaining level having taxation intentions. Converting they with the a health retreat having a great whirlpool isnt.

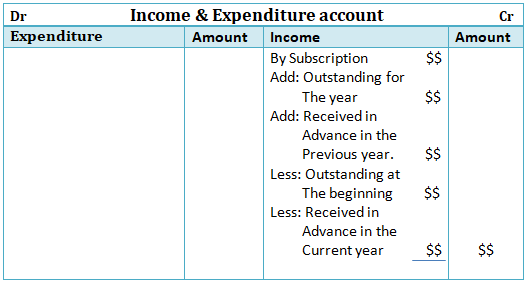

You can state new renovation can cost you on your own yearly tax get back in the way of a lump sum payment, or you can identify the real will cost you. Purchase the alternative that will enable that cut one particular taxation. You might select from year to year whether the energetic or flat-rates deduction is far more useful. You could specify whether we want to deduct the brand new lump sum payment or perhaps the real prices for state and federal taxation purposes for each person property.

The degree of this new flat fee hinges on the age of this building or apartment, and you may differs from canton to canton. Amounts is actually indicated regarding the cantonal self-help guide to taxation statements. In the most common cantons, its between ten% of imputed rental well worth for more recent features (less than 10 years old) and you will 20% having earlier qualities. For many who select the flat-rates deduction, the expenses you claim needn’t feel incurred during the complete and do not have to be noted.

If you wish to subtract the true costs, you need to give certain evidence of your own costs. If your income tax bodies can not verify this new papers, or you don’t possess all invoices, they may just allow you to incorporate a flat-price deduction.

Older buildings usually require a whole lot more repair really works. The fresh elderly the property, the higher the costs obtain, additionally the more likely its that deduction of your own real will set you back makes significantly more experience than using the predetermined fee. That have brilliant think, far more costs is subtracted to possess income tax objectives than just happen to be obtain.

To take action, group to one another several allowable restoration costs eg typical fixes, all of that is below this new lump sum payment, and you can spend some these to renovation age. After that subtract brand new productive can cost you because year. On the most other age, you could like to deduct the fresh lump sum payment.