This type of funds place a professional foundation to have homeownership, making your dream domestic a lot less off an economic continue

Diversifying your alternatives, FHA money promote different choices to match your personal demands, and get financing, refinancing choice, and you may FHA 203(k) update funds. The prospective homeowner will look for a fitting provider.

Skills this type as well as their special has actually encourages your way so you can homeownership. Think about your personal affairs, financial prospective and you may enough time-identity should make the best option and you may control the benefits of them varied FHA mortgage options.

Get Funds

Paving your way to homeownership doesn’t need to feel challenging. FHA Purchase Funds cater to first-time homebuyers, offering you reasonable terms and lower deposit conditions.

Refinancing Choices

Revisiting debt decisions that have FHA Refinancing often leads you to alot more good conditions. This calls for replacing your current financial with a new, less costly you to definitely covered by the FHA.

FHA Refinancing property inside towards the center notion of well worth for property owners. This allows into decrease in the speed otherwise month-to-month payment, or progressing of a changeable-price mortgage so you can a predetermined-speed you to definitely.

Breathing new life into the mortgage, FHA Refinancing options are versatile. It appeal to brand new Streamline Re-finance to have newest FHA mortgage proprietors or perhaps the Bucks-Away Refinance if you would like tap into family equity worthy of.

FHA 203(k) Update Loans

Remodeling your residence to meet your ideal expectations is made possible that have FHA 203(k) Improve Money. Which distinct mortgage particular makes you funds one another your property pick together with after that renovations every around that mortgage.

For those seeking improve their living space, FHA 203(k) Upgrade Money brings a practical provider. Because of the covering the costs from renovation and buy into the a single financing, it encourages a smooth homeownership and you can home improvement journey.

Skills Can cost you and Charge

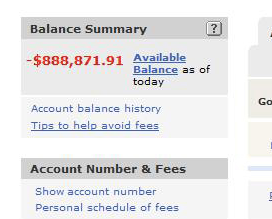

Unmasking the newest Quantity: Having FHA fund, when you are down money is actually somewhat lower, you will find more will cost you like the Upfront Mortgage Premium (UFMIP) and you may annual mortgage insurance rates. Speaking of built to cover the lending company on the chance relevant with reduce money.

Weaving from Monetary Network: A keen FHA loan involves clearly detailed can cost you and you will charges. A fundamental skills enables you to create advised decisions, working out for you effortlessly navigate such bills.

Initial Financial Cost (UFMIP)

To really discover FHA’s Initial Financial Insurance premium (UFMIP), it is essential to relish it since the essential parts of the entire cost. Paid off in the loan’s initiation, it is an effective testament into the value out-of FHA Fund.

Brand new UFMIP, even when an extra expense, ushers your into the a whole lot of masters that include FHA Money. It gift suggestions a tiny stepping-stone on the larger usage regarding homeownership.

Because the prices may seem overwhelming, equating to one.75% of your own amount borrowed, the reality that it can be rolled with the loan equilibrium even offers a monetary recovery to own basic-go out homebuyers making the dive so you can owning a home.

Annual Financial Insurance policies

Yearly Mortgage Insurance policy is a continual cost during the FHA finance you to definitely goes beyond the original costs. Intended for safeguarding new lender’s appeal, its repaid annual included in the mortgage payment.

This new perception regarding the annual fee is essential to know given that they influences the brand new loan’s long-term affordability. Despite improving the payment, the lower upfront will set you back away from FHA financing tend to cause them to become an excellent practical option for of several.

Real-Life Examples

Why don’t we discuss some actual-lives instances that demonstrate new strengthening potential Leadville North loans from FHA fund. These types of reports showcase just how ordinary people navigated the process to achieve its homeownership hopes and dreams.

- A single mom was able to get their basic household even with a modest income, due to the reduce fee requirement of an FHA financing.