Should you Open a business Membership at the Gesa Borrowing from the bank Connection?

With regards to banking, Gesa Credit Partnership feels as though a friendly neighbor who has got constantly truth be told there for your requirements. In lieu of huge finance companies, Gesa is about neighborhood, getting members earliest and you will emphasizing what most mattersfinancial better-getting.

If you live regarding Pacific Northwest, capable to give you organization borrowing from the bank options customized into the means, whether it’s a credit card, loan, otherwise savings account.

Thus, within opinion, the audience is dive to the Gesa’s roster out-of company-amicable choices, of rewards for the handmade cards to flexible finance and RI personal loans you will discounts choices. Let’s see if Gesa is a good meets for the business financial need.

What exactly is Gesa Borrowing from the bank Partnership?

Gesa Borrowing from the bank Union try an associate-possessed financial institution. It provides brand new economic means of men and women and you can organizations, particularly smaller businesses.

That it credit union was mainly based inside the 1953 of the a team of General Electronic managers. Ever since then, this has developed into one of the biggest credit unions into the Arizona condition. Gesa’s purpose should be to serve their professionals and you may communities by giving sensible lending products and you will functions. This consists of a robust dedication to supporting local people and you may neighborhood advancement.

Gesa Borrowing from the bank Union is actually dedicated to enabling small enterprises flourish. They understand one to smaller businesses are vital for the local discount and you can people.

- They give you various business checking and you can discounts profile in order to see different demands.

- Gesa participates into the Small company Management (SBA) loan applications, bringing accessibility financial support with beneficial terms.

- The treasury administration attributes help people create their money disperse efficiently.

- Gesa now offers term funds and you will credit lines to simply help organizations money operations and you may increases.

- They supply business Charge notes having aggressive prices and advantages.

Gesa Borrowing from the bank Relationship focuses primarily on staying money during the society, supporting regional schools, organizations, and businesses. When you financial which have Gesa, your help assistance these types of regional efforts and donate to all round well-getting of the area.

Towns and cities Served

Gesa Borrowing Connection suits enterprises primarily during the Arizona condition, having branches in Richland, Pasco, Kennewick, Walla Walla, Moses River, Yakima, Wenatchee, Pullman, Spokane, Puyallup, Seattle, Tacoma, Kirkland, Lynnwood, and you will Bremerton. In addition, he’s a branch inside the Blog post Falls, Idaho.

To enhance access to, Gesa even offers detailed online services, including online and cellular banking by way of the Gesa to visit application. Players can be do profile, transfer finance, make ends meet, and you may deposit checks from another location.

As well as, Gesa Borrowing Union belongs to the fresh new CO-OP Monetary Services Community, next biggest branch system throughout the U.S. This allows Gesa participants to gain access to almost 200 towns and cities when you look at the Washington Condition and you will make banking during the borrowing from the bank unions all over the country. On top of that, users gain access to more than 77,000 surcharge-100 % free ATMs nationwide, and that assurances convenient banking wherever you are.

Membership and Eligibility

To become a corporate member of Gesa Credit Relationship, the business need certainly to see certain qualification standards. People meet the requirements if they’re located in Washington state, otherwise pick areas during the Idaho and you can Oregon.

Especially, such counties within the Idaho is Benewah, Bonner, Edge, Clearwater, Idaho, Kootenai, Latah, Lewis, Nez Perce, and you will Shoshone. In the Oregon, eligible areas is actually Clackamas, Clatsop, Columbia, Gilliam, Bonnet River, Morrow, Multnomah, Sherman, Umatilla, Union, Wasco, and you can Washington.

On the other hand, organizations owned by people that real time, really works, worship, or attend school during these parts, or anyone who has a close relative exactly who qualifies, may sign-up.

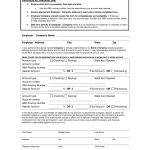

- Make sure that your business is located in the eligible aspects of Washington, Idaho, or Oregon.

- Discover an individual checking otherwise bank account that have Gesa.

- Ready yourself key company info, such as the company label, address, and tax character matter.

- Residents or signed up signers would be happy to bring individual identification (elizabeth.g., driver’s license) and confirmation recommendations according to Government criteria to battle terrorism and money laundering.