Should you Fool around with a keen LLC locate a rental Property Mortgage?

Once you own leasing assets, normally best if you hold it about term from an enthusiastic LLC, to help restrict your responsibility and build borrowing for your real house organization. However, it could be challenging to obtain a keen LLC financial, particularly if you will be carrying it out towards first-time.

Here’s how mortgages getting an LLC works, advantages and you will cons of experiencing a home mortgage using your LLC, and you can where to search to have an LLC mortgage.

What’s an enthusiastic LLC?

An LLC otherwise limited-liability team try a corporate structure owned by one or more individuals or organizations.

LLCs do not shell out fees into business level how you to C companies carry out. Instead, LLCs was admission through’ entities, which means net winnings or loss try introduced using actually to each LLC associate, stated into the Plan D out-of Mode 1040 , and you may taxed during the individual’s price.

Anyone can make an individual-user LLC or a keen LLC might have multiple professionals, such a partnership formed with regards to paying in local rental real estate. LLCs try formed within county peak, so that the means an enthusiastic LLC is created are very different out-of state to say.

If you are interested in learning how exactly to means an LLC on your condition, the brand new court resource site Nolo enjoys build an excellent 50-Condition Guide to Forming a keen LLC .

Benefits of Having Rental Possessions with an LLC

A keen LLC is also limit your courtroom liability to simply the fresh assets kept according to the LLC. Instance, when you are actually employed in case that have a renter or provider and then have a judgment up against your, this new https://paydayloanalabama.com/highland-lakes/ possessions at stake try simply for men and women held by the LLC. But not, there are lots of exclusions with the cover an enthusiastic LLC even offers, including when an investor commits downright ripoff.

For each and every member of the fresh new LLC may have some other possession proportions, otherwise various other offers of earnings and you can losses, depending on how this new LLC operating agreement is written.

Income and you can loss in a keen LLC try enacted through directly to proprietors, who after that shell out income tax according to research by the individual taxation bracket it are in.

In comparison, a c business will pay taxes at the corporate top if you find yourself investors and shell out taxation from the individual level.

Whenever home is stored in the term of your own LLC and you can dealers fool around with property government team to deal with the latest every day surgery, tenants and you can dealers wouldn’t know the names of one’s people that in fact own the genuine estate.

It is preferable to create another LLC per leasing possessions that you individual. Also preserving your private and company property broke up, it is possible to keep your individual business assets split from 1 a unique.

This way, when there is a lawsuit involving one of your functions, one other functions along with your private possessions will be secure.

Having money spent during the an enthusiastic LLC in addition to makes it simpler to get rid of eventually combination personal expenses which have providers costs, something which the newest Irs will usually look for if you’re ever audited.

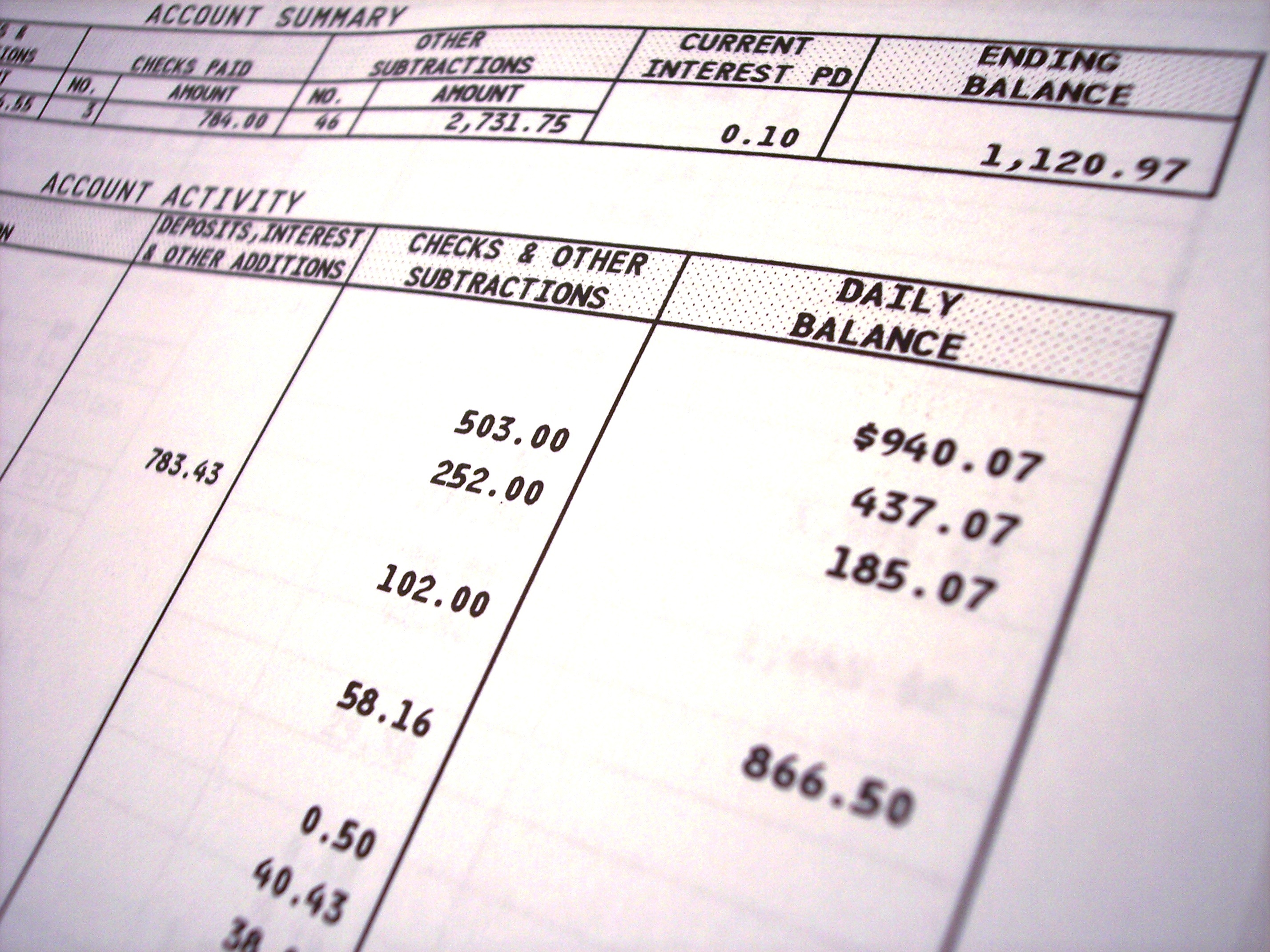

The LLC will get its very own financial, debit, and mastercard profile. Next, everything you need to would is link men and women membership along with your Stessa rental possessions monetary management application in order to automate earnings and you will expenses record and you will display possessions economic show from your owner dashboard.

Options for a keen LLC Home loan

Mortgage brokers could make it difficult to get a beneficial home loan under your LLC towards the same cause you means a keen LLC protecting your own assets.