Public Shelter Users within the Education loan Standard

- Double-upwards individuals will feel reduced-money than simply borrowers with only father or mother funds, and most 50 % of twice-right up consumers claimed receiving one social work for (the highest price of any group).

- Nearly four inside four twice-right up individuals bring delinquent credit debt, the greatest rate of every group because of the a large margin.

- More than half from twice-up consumers claim that they cannot protection three months away from expenditures that have savings, and another during the five double-up individuals says they can’t currently spend their monthly payments. (Come across Shape dos.)

- Certainly one of retired respondents, double-right up individuals are definitely the most likely group (close to one out of about three) to say that they may not endure a good $400 disaster bills.

- More seven inside the 10 double-up borrowers who are not resigned point out that their later years discounts plan is not focused.

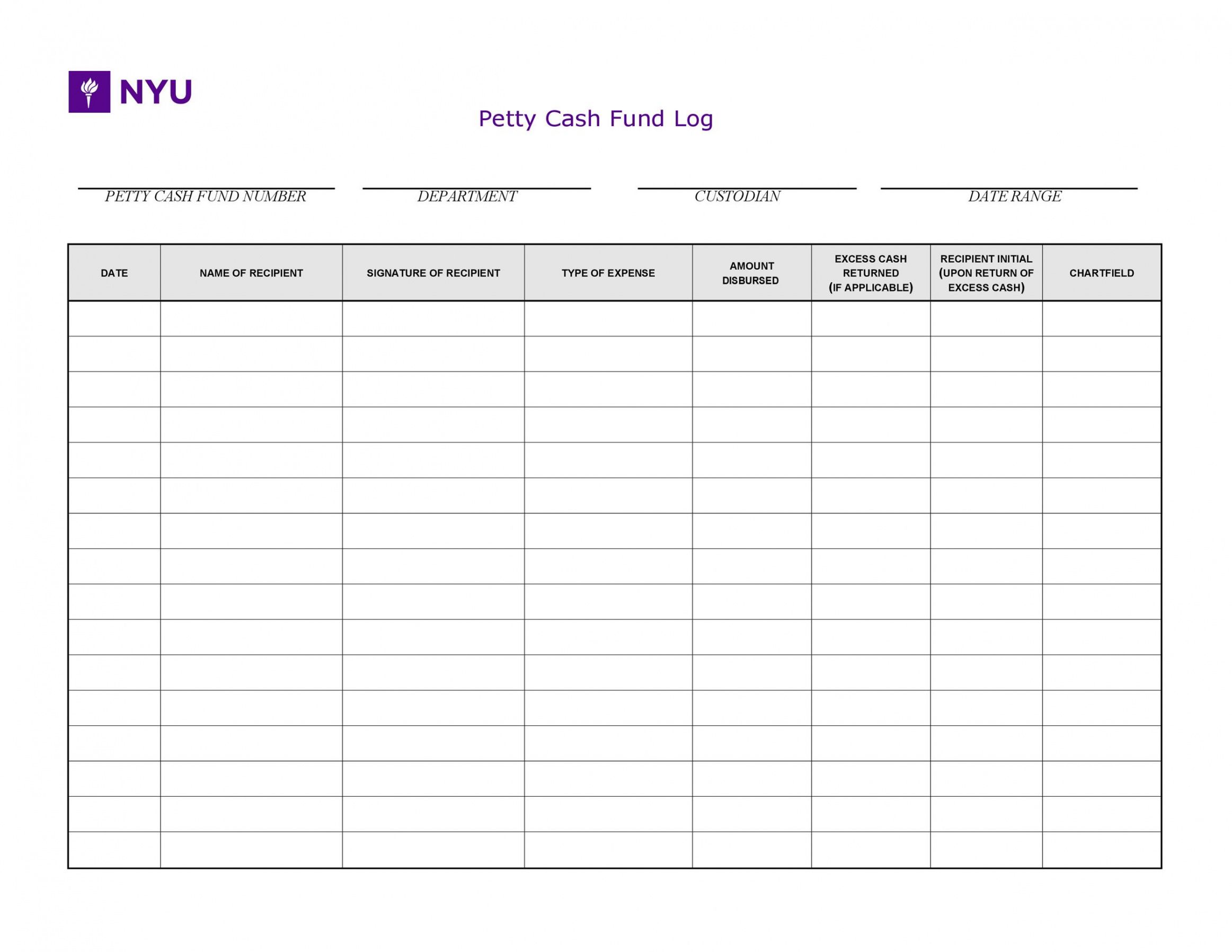

Contour dos

Particularly candles are burned at one another concludes, double-right up consumers deal with monetary pressures of both of the student education loans, causing precarious financial activities. Given that a purpose of the latest hardship caught right here, a hefty quantity of these individuals would meet the requirements beneath the hardship supply. (An appendix compared to that reviews include details on this type of mothers.)

HBCU Moms and dads

Because of over a century from persistent not as much as-funding, typically Black colored universities and colleges (HBCUs) lack the element out of mostly white peer organizations to shut affordability holes which have organization help, ultimately causing a premier intensity of Mother or father As well as loan obligations certainly one of HBCU parents. HBCUs promote a good path to own lowest-resourced parents to aid the youngster go up the income ladder; yet not, of numerous HBCU family members obtain Mother As well as because of decreased family members resources, and this in itself presents a shield in order to fees. Inside the informative seasons 201920, more than one-third of all centered undergraduate students from the individual HBCUs got mothers who took away government Direct Also Money. (Find Profile step three.) Since ilies’ Father or mother Also fund taken out for youngsters so you’re able to sit-in HBCUs totaled $5.8 mil inside the an excellent financial obligation.

Contour step three

These families’ debt can be uncontrollable, given that HBCUs had been many of the establishments on the high Father or mother In addition to standard rates: TCF keeps web site here found that HBCUs make up a 3rd regarding colleges and colleges where a significant part (over 20 percent) regarding students’ mothers default to their Mother Along with finance inside three numerous years of the beginning of installment. The burden to pay straight back Mother Along with financial obligation was amplified by the highest appeal, and therefore substances having parents with few tips, as well as real to own a giant express off HBCU group.

The newest difficulty provision of the Agency out-of Education’s advised regulatory text message angles an enthusiastic applicant’s qualifications to their odds of standard within several many years. Whenever you are federal education loan borrowers who had been inside the default in the 2020 is also heal a beneficial updates from the New Start initiative, a grandfather Including debtor whoever monetary activities haven’t rather changed will get rapidly sneak returning to standard. Based on standard statistics, they employs one to a keen outsized quantity of Moms and dad And additionally borrowers whose funds supported an enthusiastic HBCU training would likely be eligible for adversity-created rescue.

To know exactly how pernicious student loan default should be, considercarefully what is when a social Safety person defaults on the student loan. They will certainly more than likely come across portions of the month-to-month masters withheld once the a variety of bodies choices. A debtor and no most other source of income get all of a sudden end up in impoverishment range, every as they failed to pay a student-based loan costs they cannot pay for.

Social Cover withholding are a particular risk to possess Parent Together with borrowers: with respect to the You.S. Authorities Accountability Work environment (GAO), forty,000 disabled otherwise resigned Mother or father In addition to consumers saw portions of the Personal Coverage experts withheld from their website inside 2015 because of scholar loan default.