Methodology: Exactly how we had the mediocre count

Home prices for the urban areas are greater than simply those in a great deal more rural groups, so you can usually expect highest mortgage repayments, also. Like, new average household rate having Austin, Colorado try $550,000, centered on Redfin. But if you buy in the a far more outlying section of Texas, like Nacogdoches, by way of example, you’ll be able to only pay 1 / 2 of that.

Simple tips to calculate their mortgage payment

Being aware what the mortgage payment would-be is vital so you can deciding just how much home you can afford. To accomplish this, you could:

Using a home loan calculator

Home financing calculator is the best bet to have deciding exacltly what the projected mortgage repayment will be. Needed a concept of just what house rates you are looking for, simply how much off a downpayment you’re bringing, and you can latest rates of interest to utilize one of those systems.

Principal and interest dysfunction

A home loan calculator provides you with a concept of just what you are able to pay each month in the prominent and you will notice, that produce upwards a large portion of your monthly financial will set you back. On a fixed-speed financing, you’ll usually spend so much more into the focus at the beginning of your own loan. As you become then into the mortgage name, a lot more of your payments can begin supposed with the the principal balance.

Additional will cost you to look at

Really mortgage loans include escrow membership. Speaking of independent accounts that mortgage servicer uses to spend for the HOA fees, home insurance premium, and you may property taxes. You’ll spend a quantity 30 days towards your escrow account together with your mortgage repayment.

Tips for managing your homeloan payment

Your own monthly homeloan payment are one of the biggest pre approved personal loan bad credit can cost you because the a homeowner. Follow these tips to cope with your homeloan payment effectively:

Refinancing options

Should you ever will a spot where paying their home loan is tough, refinancing is able to assist. You’re capable of getting a lower interest rate, that would lower your payment, or you could rating a lengthier mortgage identity. This will spread your own commission off to longer and you can lower your percentage also.

And make extra payments

If you’d like to reduce your home loan smaller, you are able to occasional more payments to your the loan harmony. You might want to do that if the yearly income tax refund is available in or you get a vacation extra, such as for instance. You can even build a somewhat huge-than-necessary payment each month (say $2,000 unlike $step 1,950), and have their servicer to get one to more fee straight towards your own prominent balance. This may decrease your interest can cost you along side long-term.

Changing your finances

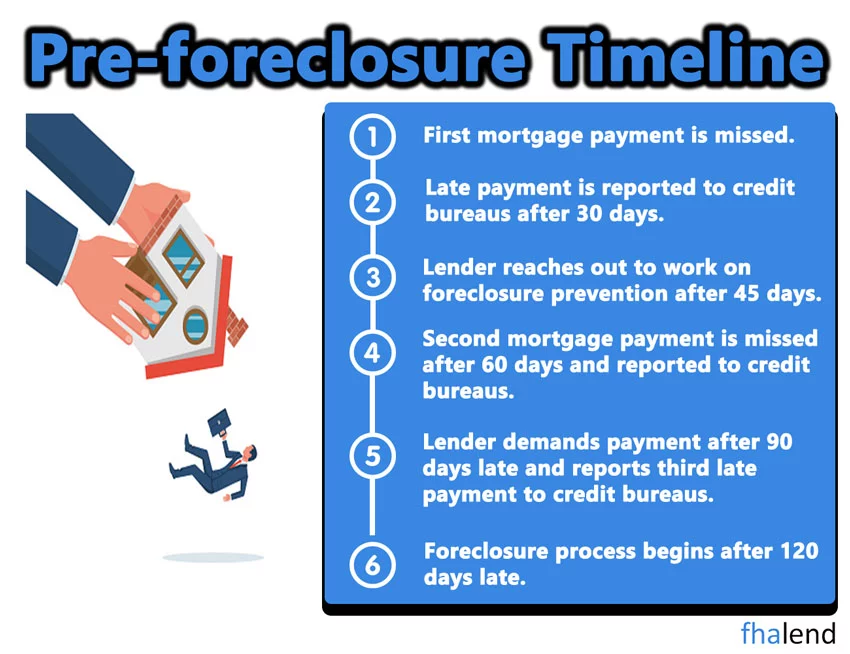

That have a great home funds in position is important every go out – however, especially when you may have a home loan percentage to fund. Failing to build your costs may cause property foreclosure, so it is critical you allocate adequate fund per month to pay your own home loan.

If you have a variable-rates home loan, its also wise to remain on most readily useful of interest rates manner and you can know the speed caps for the financing. Since your fee varies since the interest levels create, you’ll need to be ready to safeguards people payment increase that comes with you to definitely.

Faqs normally homeloan payment

To decide how much the average borrower covers their mortgage per month, we made use of the average household transformation rate considering studies from the Census Agency and also the Agency off Housing and Metropolitan Creativity. During the Q2 of 2024, the typical rates is $501,700. I upcoming grabbed the median advance payment out-of 14% (as reported by the new Federal Relationship of Real estate professionals) to determine the typical financing size of $431,462. Mediocre financial costs having according to Freddie Mac computer studies had been along with used. That it mediocre imagine cannot were fees and you will insurance coverage, since these can cost you are different widely.