Last In, First Out LIFO: The Inventory Cost Method Explained

In fact, the very oldest inventory of books may stay in inventory forever and never be circulated. This is a common problem with the LIFO method once a business starts using it, in that the older inventory never gets onto shelves and sold. Depending on the business, the older products may eventually become outdated or obsolete. In periods of deflation, LIFO creates lower costs and increases net income, which also increases taxable income. If a company uses a LIFO valuation when it files taxes, it must also use LIFO when it reports financial results to its shareholders, which lowers its net income. Last in, first out (LIFO) is only used in the United States where any of the three inventory-costing methods can be used under generally accepted accounting principles (GAAP).

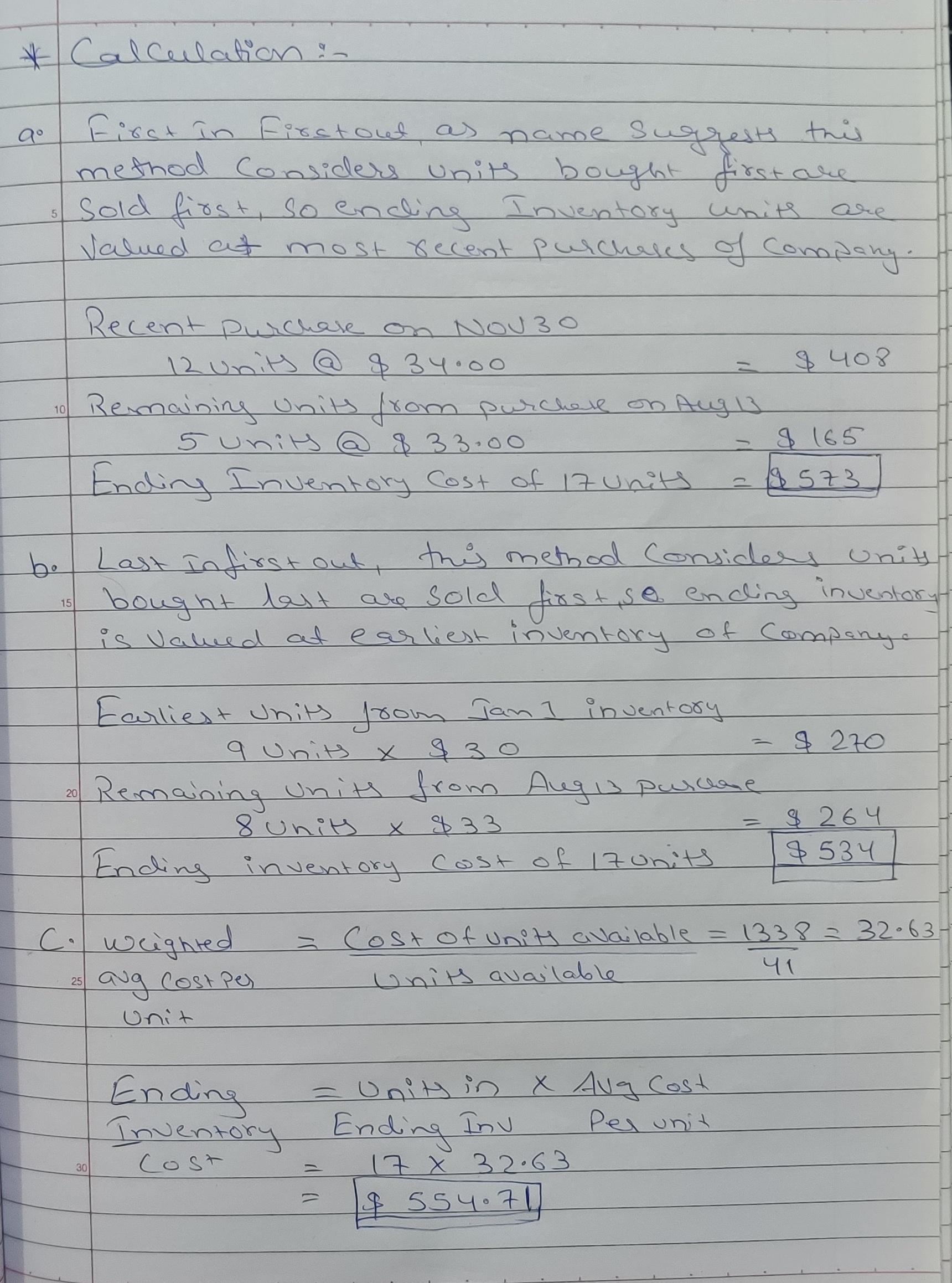

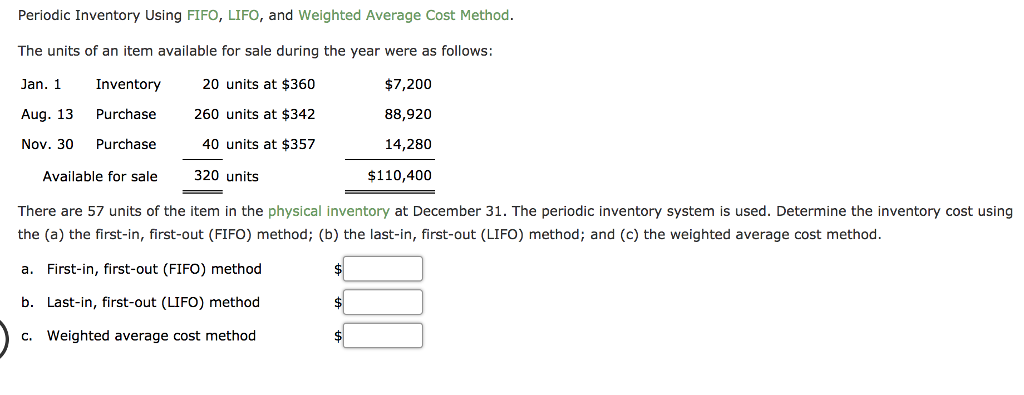

Example – LIFO periodic system in a manufacturing company:

Once March rolls around, it purchases 25 more flowering plants for $30 each and 125 more rose bushes for $20 each. It sells 50 exotic plants and 25 rose bushes during the first quarter of the year for a total of 75 items. FIFO is more common, however, because it’s an internationally-approved how to get around turbotax says “medical expenses accounting methos and businesses generally want to sell oldest inventory first before bringing in new stock. Now that we know that the ending inventory after the six days is four units, we assign it the cost of the most earliest purchase which was made on January 1 for $500 per unit.

- If a company uses a LIFO valuation when it files taxes, it must also use LIFO when it reports financial results to its shareholders, which lowers its net income.

- You can also check FIFO and LIFO calculators at the Omni Calculator website to learn what happens in inflationary/deflationary environments.

- The last (or recent) costs will remain in inventory and be reported as inventory on the balance sheet.

- Based on the LIFO method, the last inventory in is the first inventory sold.

- Furthermore, the use of LIFO can affect a company’s deferred tax liabilities.

Ask a Financial Professional Any Question

That’s either going to end up in cost of goods sold or not in cost of goods sold and stay in inventory. Actually, let’s pause here, and then we’ll do the example in the next video. In a periodic inventory system, FIFO (First-In, First-Out) and LIFO (Last-In, First-Out) are cost flow assumptions used to track cost of goods sold (COGS) and inventory. FIFO assumes that the oldest inventory items are sold first, meaning COGS reflects the cost of older inventory. Conversely, LIFO assumes that the newest inventory items are sold first, so COGS reflects the cost of newer inventory.

Last-In, First-Out (LIFO) Inventory Calculations

Prior to joining the team at Forbes Advisor, Cassie was a content operations manager and copywriting manager. With first in, first out (FIFO), you sell the oldest inventory first—and with LIFO, you sell the newest inventory first. This is slightly different from the amount calculated on the perpetual basis which worked out to be $2300. You can see the LIFO periodic method in action in the example below. The periodic system is a quicker alternative to finding the LIFO value of ending inventory.

Once the value of ending inventory is found, the calculation of cost of sales and gross profit is pretty straight forward. LIFO is extensively used in periodic as well as perpetual inventory system. In this article, the use of LIFO method in periodic inventory system is explained with the help of examples. To understand the use of LIFO in a perpetual inventory system, read “last-in, first-out (LIFO) method in a perpetual inventory system” article.

This is the reason why some prefer the periodic inventory system because of its simplicity. Your cost of ending inventory and COGS for the period comes from the schedule with no further adjustments. Notice the cost of inventory and COGS are different under the perpetual and periodic inventory systems since the goods sold come from different LIFO layers. Let’s repeat Step 2 to account for the sale that occured on January 15. We will only use the units in beginning inventory if the most recent purchases aren’t enough to cover the sale. The basic concept underlying perpetual LIFO is the last in, first out (LIFO) cost layering system.

It doesn’t matter which can, remember, they’re all identical, so this is just to deal with the cost of the inventory, not the actual physical flow of the goods, okay? So we can still even in a LIFO system, you might still want to sell off the oldest inventory because it has the nearest expiration date, okay? But there would be different reasons why you might want to use FIFO, LIFO, average cost; we’ll talk about that a little more, but that’s the big picture here is that the physical flow, right? Which can we’re actually taking out of inventory to sell to the customer, it doesn’t have to match up with this costing method we choose, okay?

This can be complex and time-consuming, especially for businesses with high inventory turnover. If the bookstore sold the textbook for $110, its gross profit using periodic LIFO will be $20 ($110 – $90). If the costs of textbooks continue to increase, periodic LIFO will always result in the least amount of profit. The reason is that the last costs will always be higher than the first costs.

The last (or recent) costs will remain in inventory and be reported as inventory on the balance sheet. In our last transaction above, we withdraw inventory costs from three different layers. We still have 50 remaining units so we go up to the next LIFO layer. The remaining layer from January 5 is only 30 units so we get all of the 30 units and proceed to the last LIFO layer for the remaining 20 units. The periodic inventory system requires a physical count of inventory at the end of the period.