How come the new USDA Home loan Operate in Clark State?

Among the many perennial drawing notes for all those wanting to circulate so you’re able to Clark State has been the ability to either individual a beneficial family on the acreage in the united states otherwise, live-in one of the several good quick metropolitan areas near Vancouver, and perhaps decelerate only a little section. It is reasonably a diminished identified simple fact that truth be told there however is actually livliehoods happening with performs and work found in the new outlying areas of the brand new Condition. To make to invest in a home in the a rural area otherwise, a rural possessions so much more possible, the government through the Department out of Farming (USDA) provides the Rural Innovation Solitary Loved ones Protected Financing Program.

Background: Outlying America enjoys a lengthy history of quality apps on the You Authorities to promote and you can improve well being and you may affordability to live in an outlying town. The newest Rural Homes Management (RHA) and you will Rural Electrification Management (today the brand new Rural Utilities Service – RUS) was basically spawned regarding The fresh Bargain software about Great Despair and Dust Bowl days, and you may considering financial help in order to outlying parts having casing and also to deploy electronic distribution and you will telephone infrastructure in order to outlying organizations. To make sure, a giant power behind these apps would be to greatest be sure the condition of United states Farming elements and number 1 dining supplies for the country. The us government company dealing with such programs try appropriately adequate, the us Agency out-of Agriculture (USDA). The brand new USDA Rural Innovation Financial has been in existence concerning exact same period of time, and also developed through the years to help you the most recent progressive setting.

- Low so you can Middle-Earnings Property are often qualified – In case your House Money is too large, you may be ineligible.

- 29 Seasons Repaired Label Money in the The present Low interest — talking about completely amortized financing and no gimmicks.

- Qualifying rations is actually 29% getting Construction and you will 41% for overall obligations.

- Be sure Commission can be applied, and might be rolling into financing.

- No Bucks necessary for the newest Advance payment. Even particular otherwise every Client’s Closing costs are funded when the eligible.

- Versatile Credit Assistance, where non-antique records is generally acknowledged.

- Eligible features tend to be: Established Home, The Framework, New Were created Land, Standard House, and qualified Apartments!

- Eligible Fixes tends to be within the loan too!

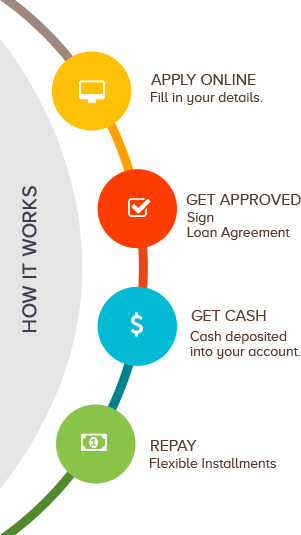

- People apply having a medication bank of its solutions (we know several good accepted loan providers).

Just what Parts of Clark Condition Meet the requirements with the USDA Home Loan?

Having Clark Condition being an integral part of more Portland / Vancouver urban area urban area, the latest USDA provides a map of your Ineligible south area of the County which means, the rest northern the main State is eligible. This is basically the chart courtesy of the newest USDA:

All of Amboy, Los angeles Cardio and Yacolt;The fresh Clark State Portion of the Forest area code;Ridgefield northern off 179th Street;much of Brush Prairie and you may Hockinson. Of these the house should be outside of the city limitations: Race Ground, Camas and Washougal. Up-date 2018: Section today excluded is actually inside urban area constraints out-of Competition Crushed, Camas and you can Washougal.

Are there Almost every other Crucial Things to Which Financing Program?

Hence, it financing cannot be used for accommodations Possessions or, feel a major fixer. If you don’t, a fairly high percentage of your own outlying Clark State residential property is always to be considered.

When i try expanding right up Clark County had been noticed good primarily outlying area however now, there has been considerable development to the extent it will sometimes getting unbelievable discover however quite a bit of “outlying Clark County” remaining! I have worked with numerous clients that truly for instance the gurus with the system.

When you yourself have an interest in such loan and you will domestic purchase delight give me a call (John Slocum) in the 360-241-7232 .