Free Balance Sheet Templates Multiple Formats

Or you might compare current assets to current liabilities to make sure you’re able to meet upcoming payments. The balance sheet, income statement, and cash flow statement make up the three main financial statements that businesses use. Companies are required by law to generate these financial statements.

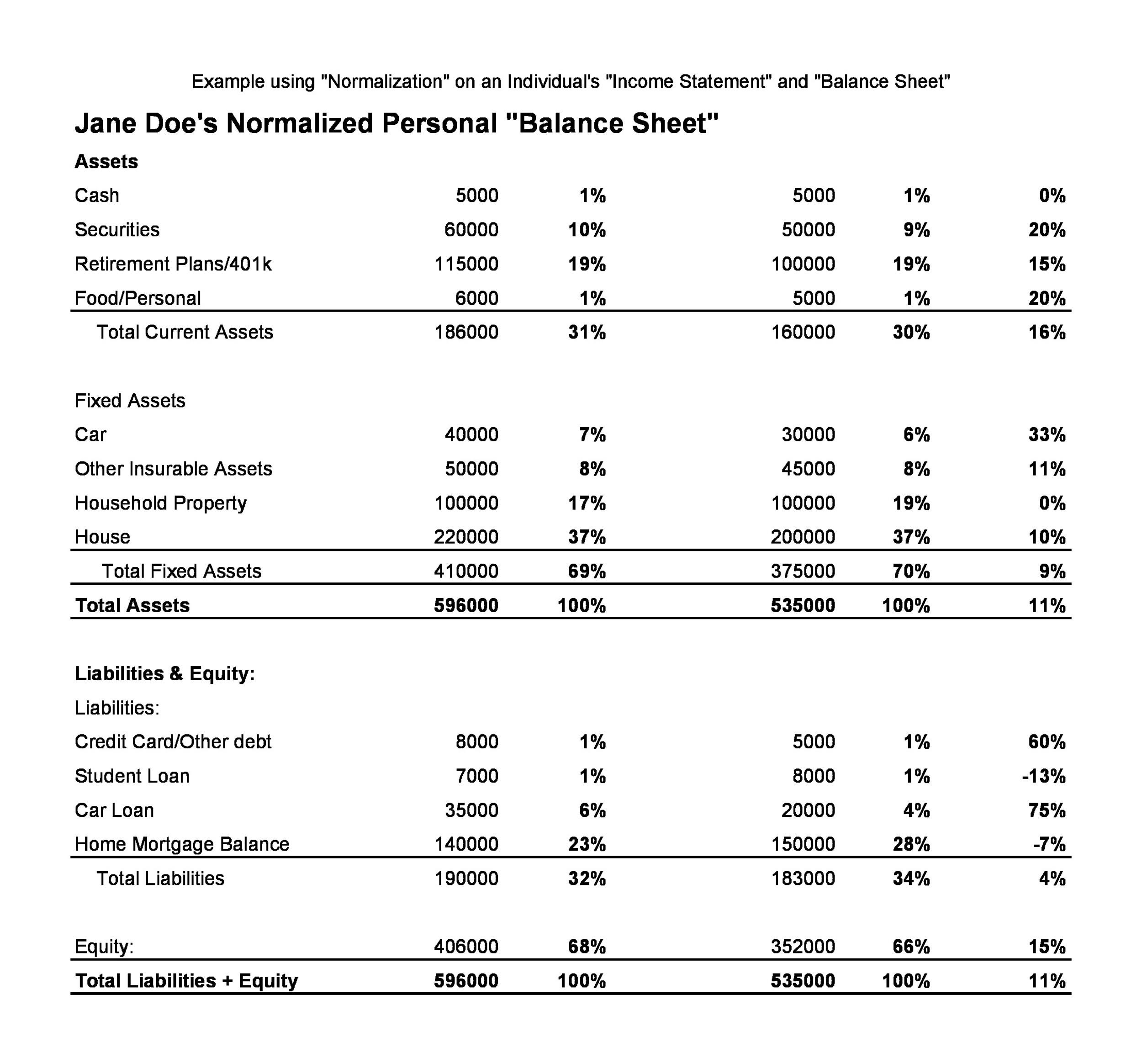

- With this in mind, she might aim to grow her easily liquidated assets by keeping more cash on hand in the business checking account.

- If it’s publicly held, this calculation may become more complicated depending on the various types of stock issued.

- This form is more of a traditional report that is issued by companies.

- Without this knowledge, it can be challenging to understand the balance sheet and other financial documents that speak to a company’s health.

Hiring an Accountant: Before and After

For Where’s the Beef, let’s say you invested $2,500 to launch the business last year, and another $2,500 this year. You’ve also taken $9,000 out of the business to pay yourself and you’ve left some profit in the bank. Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease. You’ll have your Profit and Loss Statement, Balance Sheet, and Cash Flow Statement ready for analysis each month so you and your business partners can make better business decisions.

How Balance Sheets Work

It helps stakeholders, including investors, creditors, and management, assess whether the company is financially healthy and sustainable. By analysing assets, liabilities, and shareholder equity, businesses can make informed decisions about investments, expansions, and other financial strategies. Balance sheets are one of the primary financial statements used to measure a company’s financial position. It summarizes the company’s assets, liabilities, and owners’ equity at a specific date, and it is used to calculate the net worth of the business. In this section all the resources (i.e., assets) of the business are listed.

What Is the Balance Sheet Formula?

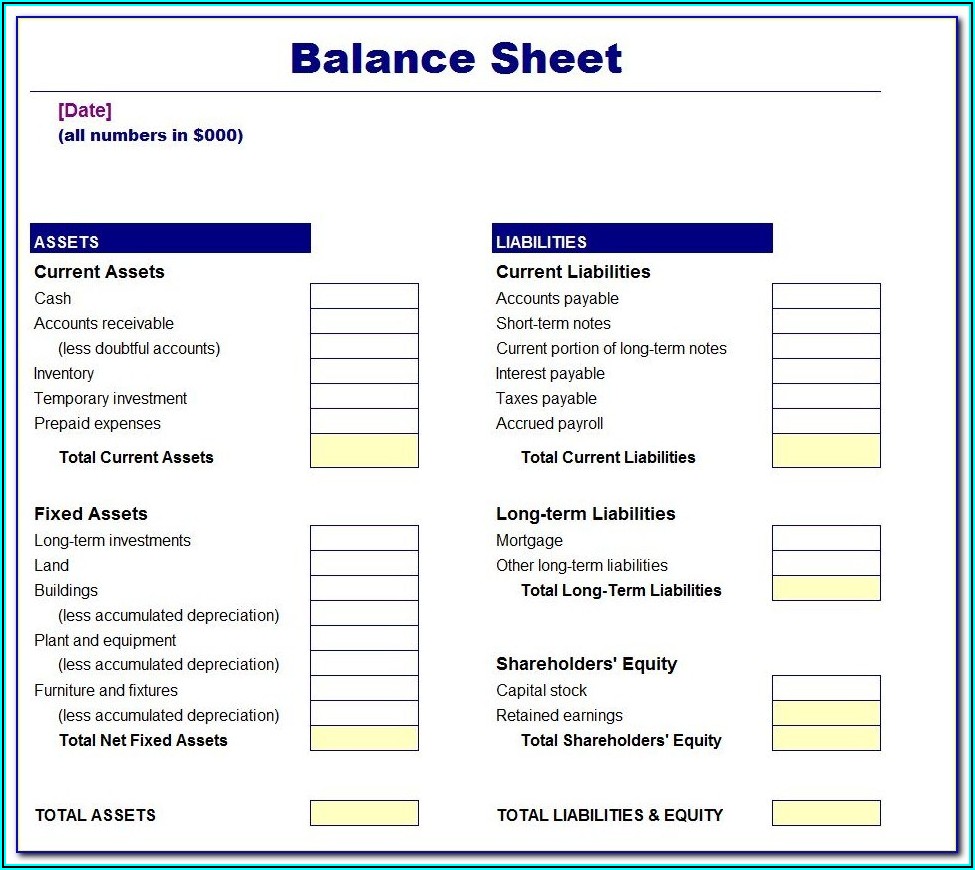

While income statements and cash flow statements show your business’s activity over a period of time, a balance sheet gives a snapshot of your financials at a particular moment. Your balance sheet shows what your business owns (assets), what it owes (liabilities), and what money is left over for the owners (owner’s equity). Use this balance sheet for your existing businesses, or enter projected data for your business plan. Annual columns provide year-by-year comparisons of current and fixed assets, as well as current short-term and long-term liabilities. By reviewing this information, you can easily determine your company’s equity.

How confident are you in your long term financial plan?

The assets section is ordered in terms of liquidity, i.e. line items are ranked by how quickly the asset can be liquidated and turned into cash on hand. If the fundamental accounting equation is not true in a financial model—i.e. The balance sheet does not “balance”—the financial model contains an error in all likelihood. Any business that runs accounting software will have the ability to create reports within the software.

A balance sheet is also different from an income statement in several ways, most notably the time frame it covers and the items included. Using financial ratios in analyzing a balance sheet, like the debt-to-equity ratio, can produce a good sense of the financial condition of the company and its operational efficiency. Long-term assets (or non-current assets), on the other hand, are things you don’t plan to convert to cash within a year.

On the other side, you’ll put the company’s liabilities and shareholder equity. By comparing your income statement to your balance sheet, you can measure how efficiently your business uses its total assets. For example, you can get an idea of how well your company can use its assets to generate revenue. A balance sheet template is a tool for tallying your assets and liabilities so that you can calculate your equity.

Because companies invest in assets to fulfill their mission, you must develop an intuitive understanding of what they are. Without this knowledge, it can be challenging to understand the balance sheet and other financial documents that speak to a company’s health. Do you want to learn more about what’s behind the numbers on financial statements? Department heads can also use a balance sheet to understand the financial health of the company. Looking at the balance sheet and its components helps them keep track of important payments and how much cash is available on hand to pay these vendors.

Verifying that these numbers match allows you to confirm that the data in your balance sheet is correct. It’s important to understand current vs. non-current liabilities because they affect your business differently and are listed separately on the balance sheet. A pro forma balance sheet makes estimates on the future effects on assets, 5 differences between tangible and intangible assets liabilities, and net worth after applying assumptions and projections to the current performance of the company. In general ledger accounts, there are two primary types which include the balance sheet and income statement. Balance sheet accounts are permanent or real accounts and are used to organize, record, and sort transactions.