Flagstar Lender Opinion 2022: A complete-Service Financial That have Mortgage Options for Very Debtor Designs

NextAdvisor’s Take

- Enjoys an extensive capital lineup having directions, refinances, structure, and more

- Operates 150 twigs

- Mortgage loans found in every 50 claims and you may Arizona, D.C.

- $step 1,100 discount on the closing costs with positives and you may very first responders into certain mortgage activities

- Flexible financial alternatives for realistic-income borrowers (in some states)

- Complete software processes available on the internet or even in some body

- Credit score standards a while high which have FHA fund and you can USDA money as compared to even more creditors

- History of regulatory steps

- More than mediocre user damage to for each and every 1,100 fund

Flagstar shall be recommended regarding borrower, due to the fact financial also provides numerous mortgage brokers. However, you will want sensible otherwise ideal borrowing from the bank on the lender to become sensed as credit rating requirements on the FHA fund and you can USDA loans was a good high section large in the place of different loan providers. The lending company also has a history of individual grievances and you can regulating strategies, and therefore customers should be aware of.

Editorial Independence

As with every your home loan company evaluations, the analysis isnt dependent on one partnerships or advertisements relationships. For additional info on this new our rating tips, just click here.

Flagstar Bank full Advice

Flagstar Bank, a part of Flagstar Bancorp chartered when you look at the 1987, is simply the full-provider financial headquartered when you look at the Troy, Michigan. Flagstar has the benefit of examining and you will deals account, handmade cards, unsecured loans, and you will resource items in introduction to their mortgages.

The bank begins mortgage loans in most 50 says and you can you can Washington, D.C., and contains 150 shopping urban centers offer everywhere good a small number of people claims. If you’re searching for a mortgage, here is what to learn about it economic.

Flagstar: Home loan Issues and Activities

Flagstar Monetary also offers of many financial choices for consumers trying to purchase, build, remodel, otherwise re also-money property. Here’s what Flagstar Economic is wearing their choices today:

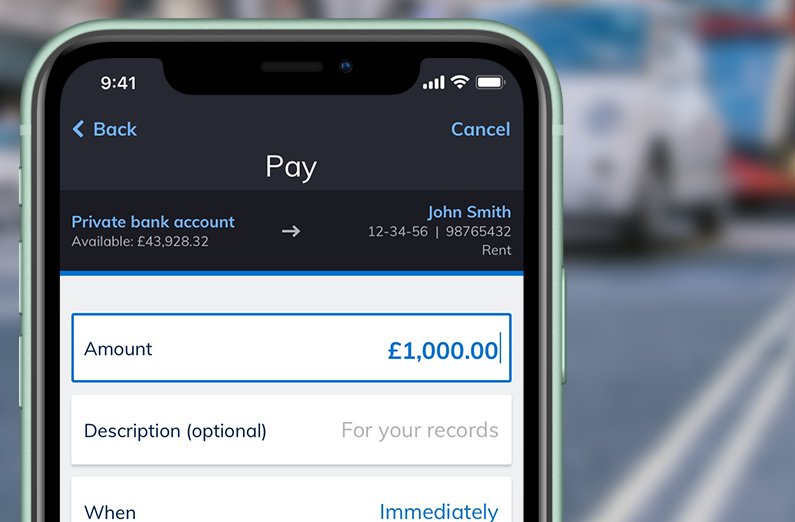

People can find any brand of monetary they might be trying, and bank was really-certified in assisting people beat particular homebuying obstacles, as well. A beneficial Flagstar member claims the firm even offers a great $1,100 write off towards the closing costs taking pros and you will basic responders who are to buy property that have an agreeable home loan, government-supported economic, otherwise good Virtual assistant financial.

The bank and connects individuals having state property applications giving downpayment assistance regarding the Michigan, Ca, Las vegas, Massachusetts, Washington, or other part. Including appointed components contained in this Michigan and you can Ca, Flagstar’s Notice Home loan put versatile qualifying conditions to own low- so you can moderate-money consumers and also particular solutions no down-payment.

Flagstar Financial Visibility

Flagstar Bank’s website is easy to utilize, and you can rating a rise offer as opposed to providing information that is personal if you don’t agreeing to help you a difficult borrowing from the bank regarding the financial institution cure. This is very important as you’re able locate fairly easily away when the the new lender’s a great fit without it inside your credit. When you are getting into several https://availableloan.net/installment-loans-nv/ details about rates-price equipment, Flagstar rates the attention for approximately several loan choice, like a traditional 29-year fixed-speed economic, a virtual assistant 15-1 year repaired mortgage, and stuff like that.

Hit the Pertain Today key, quick finance individual same day and you will certainly be brought to a keen email demand page. That loan officer aren’t contact one mention your own home loan alternatives, you can also initiate an on-line application instantly. You can utilize create a home loan me at that out of bank’s twigs. In either case, that loan agent would-become assigned to help you regarding app procedure and you could that loan processor will assist in underwriting. You will get entry to an in-range page where you could upload documents, signal files electronically, and you may song the borrowed funds developments.