Feeling from Consumer loan Foreclosures on Credit rating

Missing out on Financing Opportunities

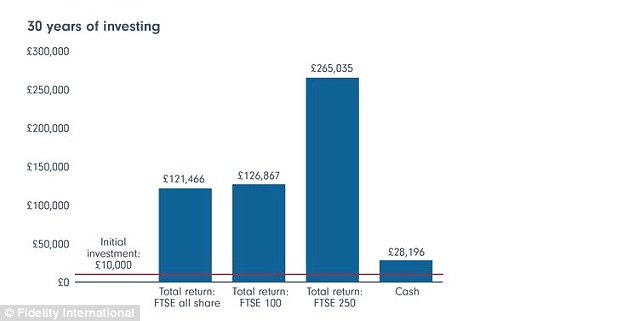

When you yourself have find a lump sum payment count, it can be utilized to possess investments in place of paying down your own present mortgage. Common finance, SIPs, holds, FDs and a lot more can supply you with higher output on your currency which you can use to pay off the mortgage. This way, you can make along with repay your loan easily.

A lot more Will cost you With it

No matter if RBI enjoys requested finance companies never to levy punishment charge towards the floating-rates loan prepayments, couple loan providers nevertheless demand penalties, particularly when its a fixed-rates mortgage foreclosure.

In the event the lender is among the most all of them, you may need to incur more can cost you, that’s hefty on the pocket according to the or unsettled amount.

Your credit rating is actually good around three-digit numerical writeup on your creditworthiness. The better your own get, the better your odds of procuring that loan. Essentially, a score regarding 750 and you may over is considered ideal for very borrowing from the bank facts.

Among important aspects inside your credit rating ‘s the age your loan and you can bank card account. When your money and you may credit cards are productive for a long day, lenders is also court if you can pay the mortgage EMIs in a timely manner.

Once you pay the EMIs without fail monthly to possess an effective long time, they improves your general creditworthiness. And therefore, it also advances your credit score because credit agencies trust your own reliability since a debtor.

For individuals who pay-off the mortgage right after paying a few EMIs, the common period of the total effective loan and you will credit card profile decreases. This may adversely feeling your credit score in the process.

List to own Loan Foreclosure

Speak about options to invest one massive amount you’ve got. If this sounds like economically far more advantageous than just opting for foreclosure, up coming avail you to definitely

Property foreclosure regarding loans is far more of use if availed prior to regarding loan period as the notice responsibility try highest to start with

It is best to take your time and you can contemplate whether you are ready to choose for financing foreclosure. Not making a spontaneous or rash choice ‘s the motto here.

Completion

Paying off the loan for the lumpsum just before their cost period is over is referred to as financing foreclosure. When you find yourself foreclosure really does incorporate numerous advantages, you will want to discover and you may comprehend the fine print.

Consider a loan foreclosures only just after most EMIs had been paid down such as to possess 6 in order to 1 year. In that case, the fresh new EMIs you paid will help improve your credit score and you may the loss incurred by financial will never be once the high. You will also have to pay down punishment in such a circumstances.

Need to get a personal bank loan which have versatile payment conditions and you may zero foreclosure punishment? Visit the Moneyview webpages or download the new application to utilize.

Frequently asked questions – Personal bank loan Foreclosure

Before property foreclosure is let, there might be a minimum loan several months you need to end investing in. Which varies with respect to the financial, so make sure you comment your loan contract or get into touching together.

Each other foreclosures and you can prepayments promote the eye off and reduce brand new financial load with the debtor. They must be produced in case the full count is actually high and you will immediately after viewing if this have a tendency to serve any better for the borrower. According to the study, you can choose often pre-percentage otherwise foreclosure.

But https://paydayloancolorado.net/brush/ not, there can be foreclosures or prepayment charges. It is vital to calculate most of the solutions or take a decision according to what is most useful for the financial predicament.

Even in the event more banks and creditors possess other foreclosure costs, they generally start around 1% in order to 5% as well as people appropriate fees. In order to make upwards to the missing notice earnings resulting about very early financing closure, the financial institution imposes which penalty.