Discover Aggressive BMO Home Collateral Personal line of credit Costs View Today!

BMO Household Guarantee Personal line of credit Cost

If you find yourself a homeowner provided experiencing the value of your domestic, maybe you have look for the term Domestic Security Line of credit (HELOC).

Skills Household Collateral

Whether your house is value $three hundred,000 therefore still owe $200,000, your home collateral are $100,000. Indiana small personal loans That it security are going to be stolen with the courtesy individuals setting, and you can a great HELOC is one of the most flexible options available.

With a definite understanding of your home guarantee was strengthening. They makes you harness the value you have collected for the your residence.

Regardless if you are believed a major renovation, looking to consolidate highest-appeal personal debt, otherwise get yourself ready for surprise costs, acknowledging how much equity you have got ‘s the first step.

The good thing about a home Collateral Credit line

So just why do you imagine good HELOC more other forms regarding borrowing from the bank? A great HELOC is actually a good rotating personal line of credit, much like credit cards.

In the place of receiving a lump sum payment, you get a borrowing limit considering your home security, allowing you to draw finance as required.

This independency is going to be extremely beneficial in handling your finances. You only pay focus toward amount you withdraw, which means if you’d like a lot less, you won’t end up being burdened which have desire into an excessive amount of money.

This could save a lot of currency whenever you are borrowing from the bank getting high-notice costs. BMO’s prices was aggressive, it is therefore a choice value investigating.

BMO’s Method to HELOC Costs

When it comes to BMO for your home equity personal line of credit, you might be curious about exactly how the prices stack up.

BMO usually even offers changeable rates which can be linked with a list, and a great margin, depending on your creditworthiness while the information on your role.

You should keep in mind that these types of rates is change based on industry standards, therefore keeping an eye on regular reputation out-of BMO will likely be useful.

Activities Influencing The Rates

You are probably curious, Exactly what determines my specific rate? High question! Several items need to be considered whenever BMO assesses and this speed is applicable for the HELOC. Listed below are some important factors:

- Credit score: Your credit history is actually a critical grounds. The fresh stronger your credit score, the better your chances of protecting a good speed. Lenders for example BMO should be sure to enjoys a last out of repaying expense responsibly.

- Loan-to-Worthy of Ratio (LTV): So it proportion measures up the amount of your home loan toward appraised value of your house. A diminished LTV ratio essentially setting a far greater speed. In the event that a lot more of you reside paid off, you will probably be eligible for a lowered interest rate.

- Possessions Kind of: The kind of assets also can affect the speed. Whether it’s one-family home, a condo, otherwise a multiple-product hold renders a change in the way BMO analyzes risk.

Economy Styles

Rates of interest is also move based on individuals sector criteria, like the central bank’s rules decisions, rising cost of living costs, in addition to overall demand for borrowing from the bank.

Keeping an ear canal to your crushed away from these fashion will help your date your application for the best you can easily rates away from BMO.

How-to Make an application for a beneficial BMO HELOC

Start with get together needed files, such proof of money, all about your existing home loan, and you may information regarding your house’s worth.

Look at this since the a way to have an unbarred talk having good BMO affiliate, who will make suggestions through their various choices centered on their requires.

Dealing with Your own HELOC Sensibly

When you secure the HELOC, the burden shifts for you. As the charm regarding easy access to loans should be appealing – especially for larger methods or costs – it’s important so you can means the line of credit judiciously.

Ensure it is a habit to help you bundle their distributions cautiously. Make use of your HELOC for purposes one to truly want it, such as for example home improvements that will increase your property value or consolidating large-attract debts.

Installment Structure

Now, why don’t we speak about just how repayment works together with good BMO HELOC. Most HELOCs has actually two phase: this new draw months therefore the repayment period.

However, if the cost months kicks within the – that past between ten to 2 decades – you will have to begin trying to repay the main next to desire.

It is crucial to package to come for this stage. Putting away fund on a regular basis in mark period, thus you are not caught out of-guard when repayments initiate, helps make a positive change.

Benefits and drawbacks from BMO’s HELOC

Like any economic device, a beneficial HELOC from BMO comes with a unique set of positives and you will disadvantages. Wisdom these could encourage you to definitely make the best choice.

- Flexible Use of Finance: You could potentially acquire what you need when you need it, providing you with financial respiration place.

- All the way down Rates of interest: Basically cheaper than just signature loans otherwise handmade cards, especially for big figures.

- Potential Tax Deductions: Sometimes, the interest paid down may be income tax-allowable when the utilized for renovations.

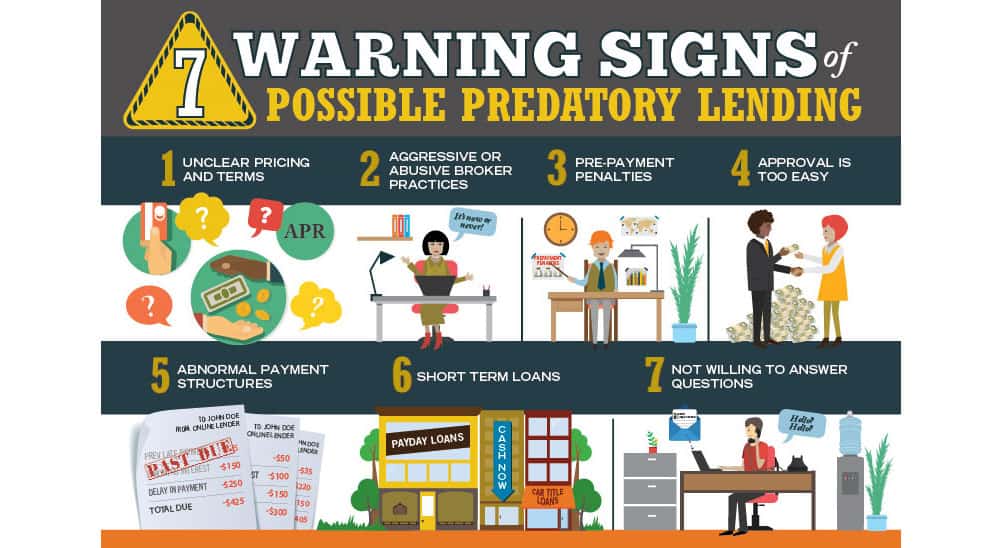

- Variable Rates: The brand new fluctuating nature of the rates may lead to unexpected expands inside monthly premiums.

- Likelihood of Foreclosures: As with any shielded obligations, if you cannot repay, it is possible to exposure losing your house.

- Debt Cycle Risk: The convenience from borrowing can lead to overspending, and also make in charge financial conclusion very important.

The significance of a spending plan

This may promote insight into just how under control debt commitments are and can allow you to make smarter choices concerning your distributions.

What’s more, it offers higher handle and profile into your monetary disease, which makes it easier to anticipate demands in advance of they develop.

Combining an excellent HELOC along with other Financial Strategies

Like that, should you decide must tap into the HELOC to possess unexpected expenses, you won’t need entirely trust it.

Playing with an effective HELOC combined with good varied financial plan can present a shield from the unpredictability out-of lifestyle.

Possible end up being better on the decisions after you know you enjoys supplies beyond merely your house guarantee to slim with the.

Seeking to Professional Economic Guidance

Their elite knowledge normally illuminate opportunities and you will downfalls you do not possess experienced, helping you navigate the fresh new commonly-complex realm of home equity funds and you will personal lines of credit.

Final thoughts with the BMO’s HELOC Costs

To summarize, BMO’s house guarantee personal line of credit costs is a fascinating option for of several home owners seeking to control the property’s value.

Knowledge your property collateral and exactly how HELOCs go with an extensive financial method empowers one take charge of your future.

Thus go-ahead, explore your options having BMO, to check out how you can make use of your home equity to get to your own hopes and dreams!

For people who located this information useful, I’d fascination with one clap for it, get-off a comment with your advice or issues, and you can think signing up for my personal Medium newsletter to have future reputation and you may understanding. Thanks for learning.