Debt-to-Equity D E Ratio: Calculation, Importance & Limitations

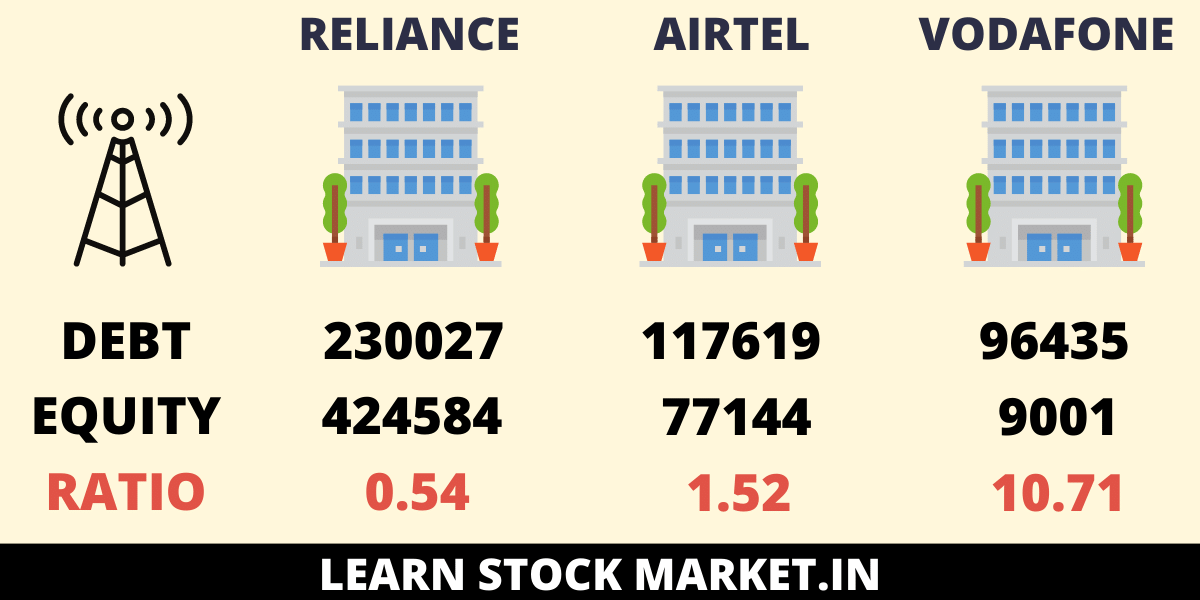

In most cases, liabilities are classified as short-term, long-term, and other liabilities. For companies that aren’t growing or are in financial distress, the D/E ratio can be written into debt covenants when the company borrows money, limiting the amount of debt issued. When making comparisons between companies in the same industry, a high D/E ratio indicates a heavier reliance on debt. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. For instance, if Company A has $50,000 in cash and $70,000 in short-term debt, which means that the company is not well placed to settle its debts. Quick assets are those most liquid current assets that can quickly be converted into cash.

What Does It Mean for a Debt-to-Equity Ratio to Be Negative?

Your company’s equity is the total value of its assets, after deducting liabilities. Business debt, or liability, is anything that you owe or anything that’s unpaid. This means any financial liabilities you’ve taken on, like a small business loan, mortgage or line of credit. Anything you have to pay back – even that unofficial loan from a mate – is classified as being part of your business’s debt obligations. If a company has a low average debt payout, this implies that the company is obtaining financing in the market at a relatively low rate of interest.

Why Companies Use Debt (Debt Financing)

On the other hand, companies with low debt-to-equity ratios aren’t always a safe bet, either. For example, a company may not borrow any funds to support business operations, not because it doesn’t need to but because it doesn’t have enough capital to repay it promptly. While acceptable D/E ratios vary by industry, investors can still use this ratio to identify companies in which they want to invest. First, however, it’s essential to understand the scope of the industry to fully grasp how the debt-to-equity ratio plays a role in assessing the company’s risk. But let’s say Company A has $2 million in long-term liabilities, and $500,000 in short-term liabilities, whereas Company B has $1.5 million in long-term debt and $1 million in short term debt. The long-term D/E ratio for Company A would be 0.8 vs. 0.6 for company B, indicating a higher risk level.

- Investors can use the D/E ratio as a risk assessment tool since a higher D/E ratio means a company relies more on debt to keep going.

- To look at a simple example of a debt to equity formula, consider a company with total liabilities worth $100 million dollars and equity worth $85 million.

- Investors often scrutinize the Debt to Equity ratio before making investment decisions.

- The general consensus is that most companies should have a D/E ratio that does not exceed 2 because a ratio higher than this means they are getting more than two-thirds of their capital financing from debt.

- Although their D/E ratios will be high, it doesn’t necessarily indicate that it is a risky business to invest in.

Cheaper Than Equity Financing

The quick ratio is also a more conservative estimate of how liquid a company is and is considered to be a true indicator of short-term cash capabilities. Managers can use the D/E ratio to monitor a company’s capital structure and make sure it is in line with the optimal mix. The principal payment and interest expense are also fixed and known, supposing that the loan is paid back at a consistent rate. It enables accurate forecasting, which allows easier budgeting and financial planning.

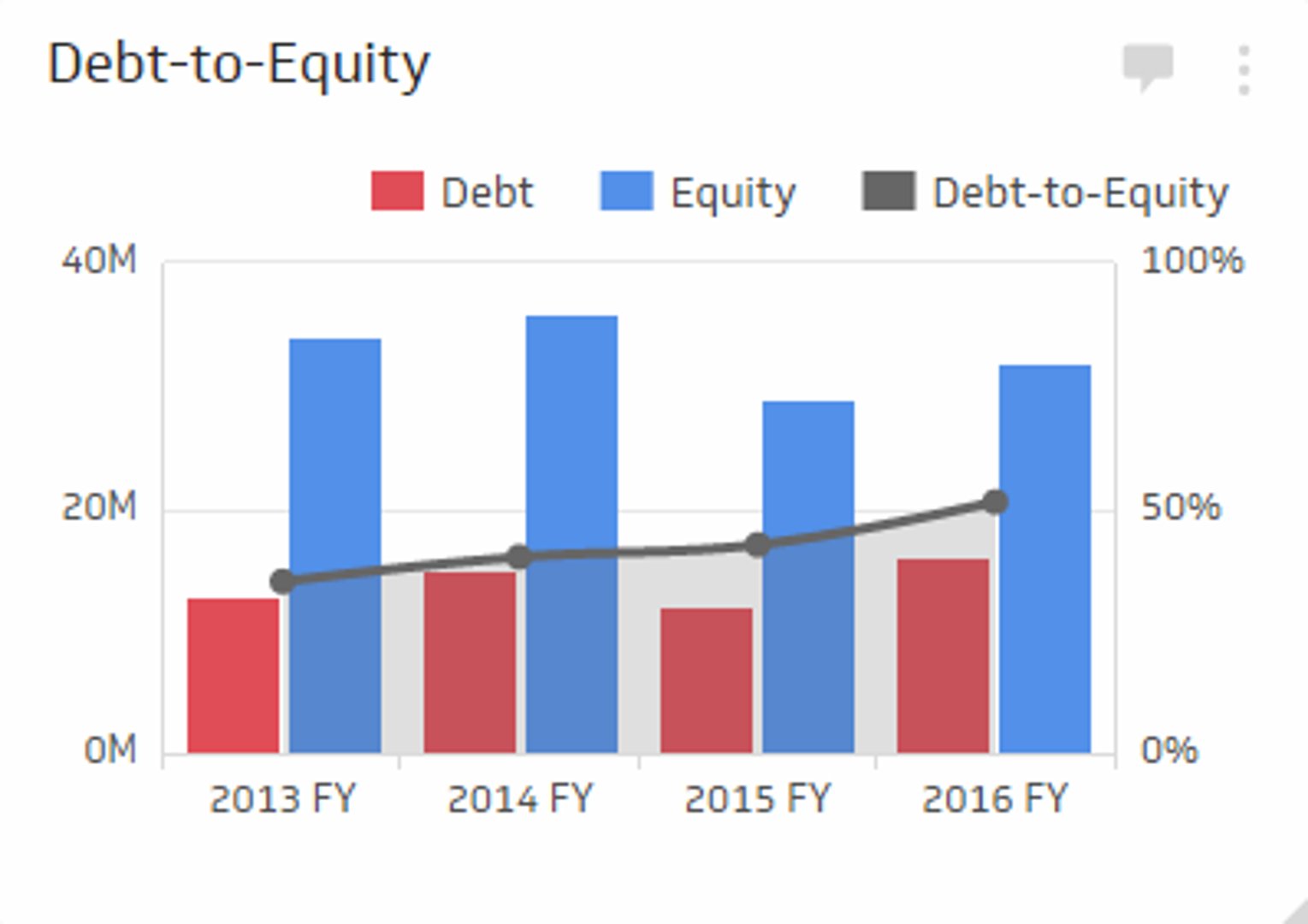

While this can lead to higher returns, it also increases the company’s financial risk. An increase in the D/E ratio can be a sign that a company is taking on too much debt and may not be able to generate enough cash flow to cover its obligations. However, industries may have an increase in the D/E ratio due to the nature of their business. For example, capital-intensive companies such as utilities and manufacturers tend to have higher D/E ratios than other companies.

Profit and prosper with the best of Kiplinger’s advice on investing, taxes, retirement, personal finance and much more. For example, utilities tend to be a highly indebted industry whereas energy was the lowest in the first quarter of 2024. Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

They may monitor D/E ratios more frequently, even monthly, to identify potential trends or issues. Economic factors such as economic downturns and interest rates affect a company’s optimal debt-to-income ratio by industry. A D/E ratio close to zero can also be a negative sign as it indicates that the business isn’t taking advantage of the potential growth it can gain from borrowing. Coryanne Hicks is an investing and personal finance journalist specializing in women and millennial investors. Previously, she was a fully licensed financial professional at Fidelity Investments where she helped clients make more informed financial decisions every day.

On the other hand, a comparatively low D/E ratio may indicate that the company is not taking full advantage of the growth that can be accessed via debt. Simply put, the higher the D/E ratio, the more a company relies on debt to sustain itself. Liabilities are items or money the company owes, such as mortgages, loans, etc. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

A company’s accounting policies can change the calculation of its debt-to-equity. For example, preferred stock is sometimes included as equity, but it has certain properties that can also make it seem a lot like debt. Specifically, preferred stock with dividend payment included as part of the stock agreement can cause the stock to take on some how to use xero settings characteristics of debt, since the company has to pay dividends in the future. Many startups make high use of leverage to grow, and even plan to use the proceeds of an initial public offering, or IPO, to pay down their debt. The results of their IPO will determine their debt-to-equity ratio, as investors put a value on the company’s equity.