Concealing from inside the Ordinary Sight | Shocking Virtual assistant Loan Funding Charges, Informed me

Sr loan places Dolores. Underwriter | FHA De, Va SAR, USDA

Discovering the excess dos.15% commission on my Virtual assistant mortgage was a startling disclosure, including an urgent $8,600 with the cost of good $eight hundred,000 assets.

To own experts who had used a Va mortgage, the latest financial support payment escalates to an even more daunting step three.3% when an experienced really does a no downpayment financing. It means on a single $400,000 loan amount, the price skyrockets to help you $thirteen,200! And these costs are on the top practical bank closing costs, assessment costs, insurance, and.

From the effect a feeling of disbelief and you will outrage, a sentiment I soon realized is shared by many people almost every other seasoned homeowners.

When i earliest found these charge when using a good Va mortgage having a house get when you look at the Southern Ca, I was taken aback. It featured excess, almost penalizing. Regardless of the 1st surprise, We delved greater, uncovering reasons you to led me to realize the latest Virtual assistant financing getting my household in the Tangerine County.

The new Va resource percentage was a single-big date payment your Seasoned, provider member, otherwise survivor pays on an excellent Virtual assistant-backed otherwise Va lead home loan. It fee helps you to reduce steadily the price of the mortgage to own You.S. taxpayers while the Virtual assistant mortgage system has no need for down repayments otherwise monthly financial insurance coverage.

As for my records, We have supported once the a mortgage underwriter for a couple of+ decades-examining over 10,000 fund throughout the my personal career-and you will are as well as an experienced of the Us Marines Reserves.

Let this Virtual assistant mortgage recipient to walk your because of as to the reasons, even with one first surprise, this type of financing are often good choice for veterans such as for instance me personally.

My Va Mortgage Sense

This personal expertise placed the origin for my understanding of Virtual assistant fund, that we will now determine in detail.

Back to 2010, we gone into the with my during the-laws and regulations after making Virginia so you can head back toward Western Shore. Having a baby and you can dos-year-old baby in the pull, we desired a fresh initiate close nearest and dearest inside our household condition out of California. They assisted united states get back towards the feet, and very quickly sufficient, we had been happy to buy all of our set once again.

I noticed and compared one another Va and FHA money accomplish therefore, knowing each other render lower down-commission alternatives as opposed to others.

Attracting away from my personal process of opting for between Va and you can FHA funds, why don’t we delve into a comparative studies to understand its peculiarities.

Relative Analysis- Comparing Virtual assistant and FHA Money

In addition, off a factual perspective, an evaluation from Virtual assistant and FHA financing you certainly can do to create an informed decision.

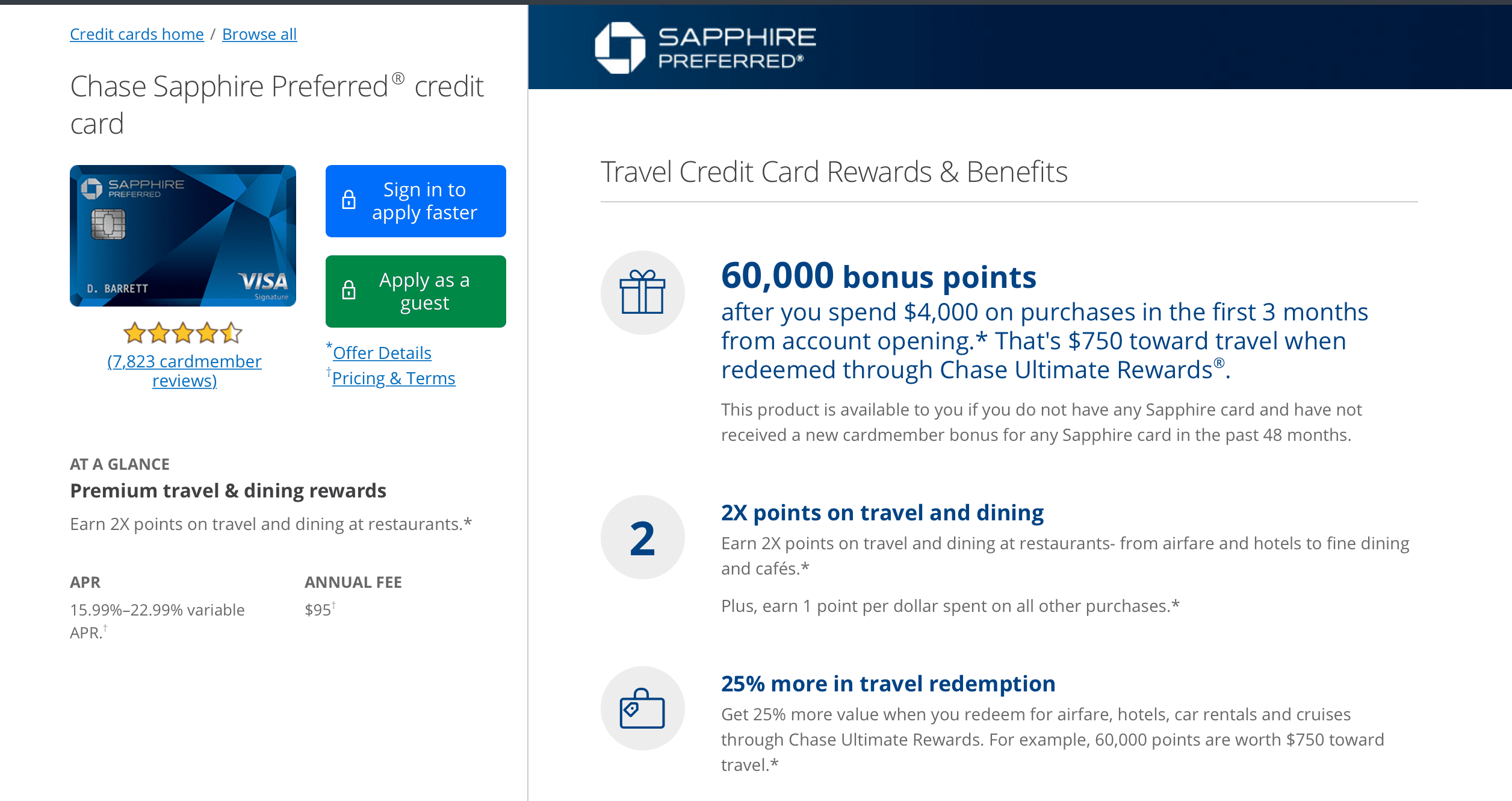

ConsumerAffairs provides a thorough comparison graph, adding depth on understanding of these types of mortgage systems. It graph even offers an in depth report about the distinctions, helping you to look for which financing might possibly be more suitable getting your position.

For every financing particular offers distinct experts designed to different debtor demands. The final solutions lies in this requirements of any individual otherwise friends.

Va Loan

You to big difference-and why my loved ones chosen a good Virtual assistant financing-is they don’t require monthly financial insurance. Getting down 5% normally clipped the fresh financial support fee to one.50%.

The newest table lower than is about U.S. Service regarding Experts Factors website breaking down the many levels of funding charges centered on downpayment.

FHA Mortgage

FHA loan amount a lot more than an effective 95% loan-to-well worth ratio (LTV) means payment out-of home loan insurance policies towards complete financial term. Such, for folks who secure a thirty-12 months fixed mortgage on 96.5 LTV ( 3.5% downpayment ) monthly home loan insurance policies are required having 3 decades, if you don’t can pay off of the loan before.

- Va financing be noticeable having perhaps not demanding month-to-month financial insurance and offering all the way down financial support charges just in case you produces a straight down commission, leading them to such advantageous to possess eligible experts and solution members.

- Simultaneously, FHA money, with regards to more easy credit criteria and you may reduced off money, will be a very accessible option for a greater range of homebuyers.

Having browsed the difference between Virtual assistant and FHA finance, each loan particular provides book masters and considerations. To further assist in navigating these solutions and finding out how it you are going to impression your finances, let us now turn to certain basic devices that will offer more understanding and you can assist in choice-to make.