Chat to your financial from the which option is right for you

For the majority of homeowners, good fixer-upper is their idea of an aspiration home. Yet not, the entire process of to acquire an effective fixer-top boasts additional duties compared to the features inside the better reputation or this new construction home. Getting ready for the method comes down to undertaking a remodeling plan, being aware what to search for when searching for postings, and you can insights just what money choices are readily available.

Planning for an excellent Fixer-Top

Fixer-uppers need the next-depending mindset. Understanding the magnitude of your strategies you and your household was willing to accept will help function your finances and you can your own requirement as time goes on. With a few very first rates analysis for the provided venture, you will have to pick be it worth every penny to get the fresh product your self and you can do it Do-it-yourself or hire an expert. Whenever investigations the waters for elite group building work, rating certain estimates so you can examine can cost you anywhere between builders. Keep in mind that in addition to the advance payment and you will closing fees, the expenses employed in a fixer-top pick could potentially discuss-finances without difficulty. Learn permitting in your area to learn just how to browse people courtroom hurdles throughout the restoration techniques also to best evaluate the schedule for your house update systems.

Trying to find a beneficial Fixer-Higher

- Location: Whether you’re to find good fixer-higher which have intentions to sell it, lease it, or live in they, envision their venue before purchasing. If you are intending into promoting otherwise leasing, area is one of the most tips in making a good value for your dollar. And if you’re gonna reside in the fixer-top, just remember that , area could well be a corner out of the experience with your house. If you are searching to sell sooner, talk to your representative to spot large Return on your investment renovations ideas you to definitely tend to pique visitors interest in your area.

- Scope out-of Repair: If you are looking for a smaller sized size repair, discover listings that require beauty products programs such as for instance the indoor and external decorate, fresh carpet and floor, appliance upgrades, and you will basic land repairs. More expensive and you will with it ideas were re-roof, replacing plumbing system and you can sewer traces, replacing Hvac systems, and you may full-size area remodels.

- Employing a contractor for your Redesign

- Inspections: Past a basic household check, which covers components of the home such the plumbing and you may basis, think authoritative monitors to possess insects, rooftop criteria, and you will engineering accounts. This will help distinguish involving the property’s slight defects and important problems, subsequent advising your choice when the time comes to prepare an enthusiastic render.

- How do i make an offer into the a home?

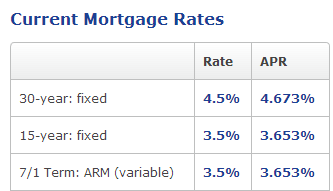

Investment Possibilities

You will be thinking about different types of mortgages when buying an excellent fixer-top, however, keep in mind that recovery loans especially succeed buyers to help you funds the home therefore the advancements toward possessions to each other. Most consultation services, inspections, and you can appraisals are usually required in the mortgage procedure, nonetheless help guide work and you can resulting household value.

- FHA 203(k): The fresh new Federal Homes Administration’s (FHA) 203(k) finance are used for extremely systems undergoing upgrading a house. In comparison with traditional mortgages, they could accept straight down earnings and you can credit ratings to have licensed borrowers.

- Virtual assistant repair mortgage: With this specific loan, your house upgrade costs are combined on the amount borrowed to have the house purchase. Contractors employed in people home improvements have to be Va-recognized and you may appraisers involved in the appraisal procedure need to be Va-official.

- HomeStyle Loan Fannie mae: The HomeStyle Restoration Mortgage can be used by the consumers to acquire a fixer-top, otherwise of the property owners refinancing their houses to purchase developments. That it mortgage in addition to makes it possible for deluxe projects, such pools and you can land.

- CHOICERenovation Mortgage Freddie Mac: So it repair financial is protected compliment of Freddie Mac computer, allowing ideas one to reinforce a great home’s ability to endure disasters otherwise resolve damage because of a last emergency.

While you are seeking to buy a good fixer-top, https://clickcashadvance.com/installment-loans-or/ontario/ apply at myself I could make it easier to see the techniques and to talk about just what helps to make the most sense for your requirements.

I earn this new faith and you may loyalty of one’s agents and clients performing a home exceedingly better. The leader in the industry, i submit visitors-centered solution into the a real, collaborative, and you may clear fashion and with the unmatched studies and assistance one is inspired by age of experience.