Appreciate a back-up Along with your HELOC

You Have earned More!

PeoplesBank is just one of loans in Sumiton the top area finance companies for the Pennsylvania and you can Maryland – especially when you are considering home security loans. Once you spouse with our company for the mortgage, you’ll be able to make use of a good household security loan price.

- No maturity day make use of your home security mortgage as it’s needed

- Power to secure a predetermined rates

- Zero percentage so you can protect a fixed rate towards the equity money

- Small recovery day typically fewer than 10 business days to close

Often you want a little extra cash to be successful and you will goals. ount you’re looking for when planning on taking your ideal travel, or perhaps you happen to be short with the requisite financing to follow a beneficial once-in-a-life funding chance. Whatever the state, there is certainly a high probability you can purchase the bucks need by firmly taking benefit of a secured asset you currently individual: your home.

A house guarantee financing will allow you to borrow cash up against the newest security you have got in your home. Basically, new equity ‘s the value of your house minus one liens connected with they. Your home is the latest security for the loan, while the currency your use try a to utilize however you you desire. You can utilize a property collateral mortgage to cover their biggest monetary requires, create a back-up for future years otherwise repay obligations such as scientific expenses and you may fund out of university.

PeoplesBank is the trusted partner to have household guarantee loans within the Pennsylvania and you will Maryland. We’re here to learn the professionals and you can risks of this a property collateral financing or credit line.

Rating a simple House Equity Loan

If you would like mark on your collateral, your commonly you need those funds fast. You’ve got a motor vehicle fix you need to pay to possess otherwise a surgical treatment that must be performed in the future. PeoplesBank is here now for your requirements. While many financial institutions grab months so you can accept a home security mortgage, PeoplesBank could possibly get your money easily. We have house collateral fund open to owners out of York and you can Lancaster, Pennsylvania, and Baltimore, Maryland, while the encompassing components. You can found approval in as little as 10 months.

Romantic on the mortgage once ten months once using and enjoy the relief from a quick recovery. You could potentially stop taken-away inquiries on the credit and you may days regarding getting document once file up on request. Our very own brief processes occupies a reduced amount of time and gives your use of your bank account proper when it’s needed.

Sign up for an online family equity financing to keep way more day. Fill out the design on comfort of your house getting greatest comfort. We will arrive at really works instantly, therefore we can also be agree you to find the best HELOC cost when you look at the Pennsylvania and you can Maryland.

Make use of your Residence’s Equity To help you:

- Create renovations: When you are taking on a remodeling endeavor, a home equity financing are an easy way to find the funds you desire and you will invest her or him right back into the possessions.

- Book an aspiration travel: Vacations and other highest, one-go out expenditures can be hard to coverage which have coupons alone. Which have a house equity mortgage, you could potentially heed a predetermined count when you are managing yourself to a dream holiday.

- Shell out college tuition: Often figuratively speaking commonly enough or are not a choice after all. Property guarantee mortgage allows you to obtain the cash you significance of a fixed rate.

- Repay personal debt along with your HELOC fund: A good HELOC, or domestic collateral credit line, allow you to use your domestic because security having competitive appeal pricing. This credit line now offers the greatest window of opportunity for one pay-off the bills.

- Plan retirement: Once you purchased your home, you have made an investment on your own future. A home guarantee mortgage allows you to try it again.

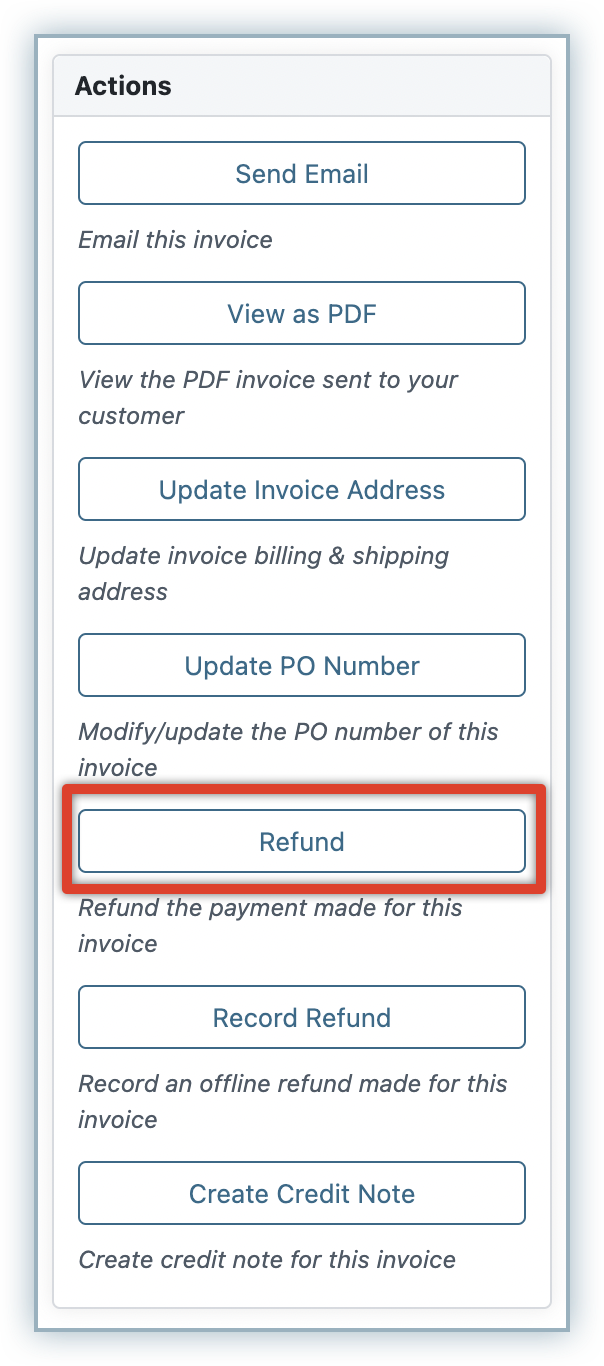

Unexpected issues normally make you and get cash on small notice. With good HELOC to draw on normally place your head during the ease. If you’d like a root canal or this new tires to suit your auto, purchase them with effortless access to an excellent HELOC.

When you yourself have a good HELOC, you can purchase the cash as quickly as you’re able to draw funds from your bank account. Sense reassurance knowing you could potentially shell out your expenditures that have funds from good HELOC in lieu of applying it a card card, which has actually a high interest rate.

HELOCs can pay for larger projects otherwise expenditures you to definitely occur aside of the blue, also. Maybe their dryer might have been striving having months, and past they finally stopped working. You can get a unique you to effortlessly with your HELOC. Perhaps your homes roof abruptly already been dripping and insurance wouldn’t cover a replacement. That have a great HELOC, you could potentially pay money for the latest rooftop without worrying about the latest roof businesses large interest rates toward funded repairs.

If or not you live in Lancaster, York, Baltimore or another regional city, you can delight in the safety from an excellent HELOC having PeoplesBank. Run united states to possess immediate access so you’re able to emergency funds as a consequence of a HELOC.

Prepared to Start off? Submit an application for an online House Guarantee Financing Today

In place of putting off your goals, then make use of your home’s equity to ensure they are to the an effective facts? As you prepare to find an instant household guarantee loan, PeoplesBank has arrived to help. Pertain today having fun with the smoother online form.