Along with, USDA home loan cost are typically lower than other home-financing pricing

History take a look ats towards anyone applying for an FHA or USDA financing usually gauge the individuals credit rating and you will credit history, guarantee the person’s latest work updates, and verify the individuals label

- Tax versions over the past 24 months

USDA financing qualifications declare that no money needs as the a beneficial downpayment to buy a Oregon personal loans property. Here is the merely program found in the brand new U.S. that offers no-off mortgage loans for people who aren’t military veterans.

Background records searches with the some body applying for an enthusiastic FHA otherwise USDA mortgage often assess the man or woman’s credit rating and you will credit score, guarantee the individual’s most recent work condition, and you may be sure the individuals name

- Proof of a job over the past a couple of years

- Credit rating with a minimum of 620

- You should never has stated bankruptcy in the past three years

- Can’t be unpaid for the people federal personal debt, along with restitution

- Background check

Criminal background checks on the some one applying for an FHA or USDA loan usually gauge the person’s credit history and credit score, be certain that the individual’s most recent a career position, and be sure the individuals label

- Names and you may contact of all the employers plus spend stubs on the early in the day few days

- Separation and divorce decree or youngster service agreement if the purchasing or choosing youngster service

- Income tax versions for the past 2 yrs

- House declaration over the past month

Extremely lenders dont run background records searches to the mortgage people. However, they’ll see the credit file, be certain that the earnings, and be sure the abode over the past ten years.

When selecting a home, such funds are great for felons just who usually do not have enough money so you can be eligible for home financing thanks to conventional loan applications. So it normally takes place off in prison no business, that have no earnings to own a period, being not able to pay the bills.

Parents in the home usually struggle economically when you are felons try incarcerated, and bills increase. That it apparently contributes to declaring case of bankruptcy and financial instability whenever felons get done its phrase.

They may be able as well as focus on building the credit rating and you can have indicated the want to alive a genuine lives of the going right on through a great re-admission system or getting then degree and you may education to discover the education and you may enjoy they must look for a position

Its credit rating is often quite low right down to these types of fight. Felons often have a shaky performs background as well. They have not stored a job into the people because they was in fact sentenced to prison. Having felons in this instance, FHA or USDA financing are a good way to get an effective house.

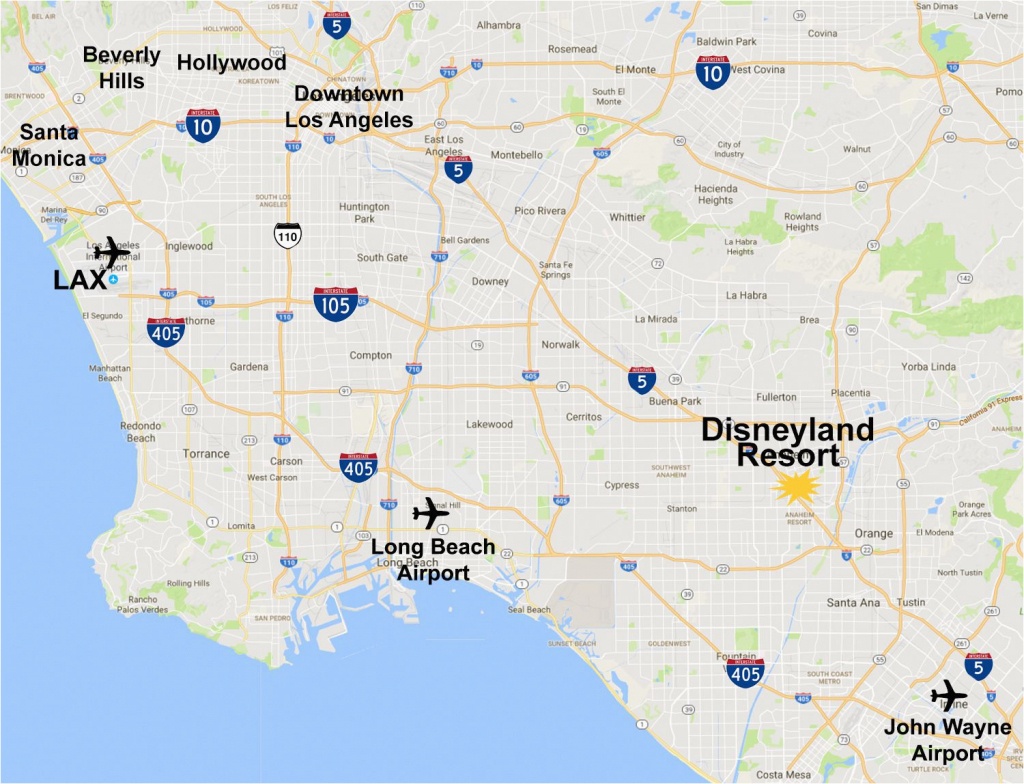

FHA and you will USDA loans also provide competitive interest rates, that fall into line which have field-style. That have USDA finance, we advice to purchase when you look at the outlying portion. The latest USDA loan was a rural property financing that provides the newest benefit of perhaps not demanding a down-payment and never having an effective limitation household cost.

not, you will need to remember that it loan, available with a national service, has specific possessions requirements you to definitely mandate the house become based in an outlying town. Likewise, you can find income restrictions for the customer, and you may mortgage insurance is required for the entire mortgage label.

Felons has to take their mission definitely and get chronic. It will not be very easy to get assets. Creating the things which it takes to arrive you to definitely objective and buy a property might possibly be tricky, but what was not as making prison?

The most important thing to possess felons not to ever lie to the home financing app. This can include offering not the case recommendations, omitting earlier work, fabricating early in the day companies, as well as being dishonest about their criminal record. Sleeping regarding a crime toward a mortgage software constitutes con, punishable of the possible jail date.

Felons should be prepared to perform what must be done. They might need live-in an apartment or any other quick-identity houses at first up to they could get on their own when you look at the a position being buy property.