Even although you shell out the expenses punctually per month, problems is slip into your credit report

Double-choose and you will delete people out-of-day beneficiaries in your providers-sponsored life insurance policies and you can 401(k) package, particularly if you were unmarried once you been your job. “Whenever discover a primary lifestyle alter, you really need to see those beneficiary statements,” states Dee Lee, a certified economic planner which have Harvard Economic Teachers. Your mother and father, sisters, otherwise a previous companion can still getting listed unlike she or he.

3rd Few days

So it day, you will need to check your credit score and rehearse all that paying advice you’ve been gathering to help make a formal finances.

Check up on your credit.

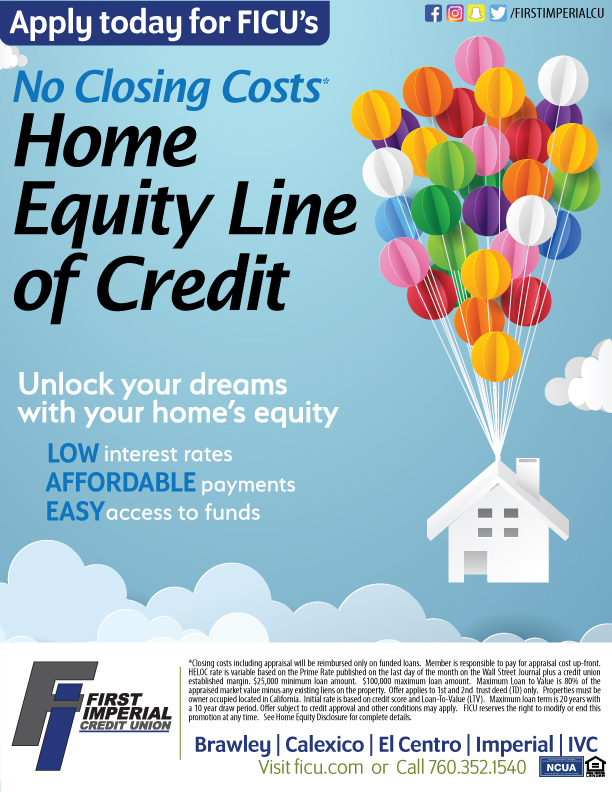

Save time and you can problems of the fixing mistakes today, when your every day life is seemingly sane. That have an effective credit score is very important when you are a father-to-be and probably looking at large instructions including a property or a car in the future. That have a top credit history can help you protected the fresh new best interest rate on a car loan or home loan.

You could to purchase your credit file out-of Equifax, Experian, otherwise Transunion. By-law, they could costs no more than $several to possess a standard statement. End up being forewarned one to applying for a free of charge credit score assessment from quicker reliable providers might be an invitation in order to id theft. On the other hand, limit yourself to only 1 view annually-anymore than simply which can damage your ranking.

Crisis new amounts.

Now you have locate right down to the last action out of budget-to make. Take all brand new quantity regarding the expenditures you’ve got monitored the fresh new previous few months and place them when you look at the an excellent spreadsheet otherwise budget record software (for folks who haven’t currently). This may leave you a complete image of your current expenses-before you can give them a transformation to arrange for baby.

Your ultimate goal isnt to just break even, however, to save money on a regular basis, claims Stephen Brobeck, executive manager of one’s User Federation of America (CFA), a keen advocacy and you may studies organization during the Arizona, D.C. An effective 2019 survey by Bankrate unearthed that one out of four doing work People in the us aren’t saving hardly any money getting senior years, an urgent situation money, or other long-title monetary specifications.

When making the new funds, remember your future childrearing will cost you. Considering a great 2015 USDA declaration (the newest study available), the common middle-money property should expect to invest in the $step one,056 thirty day period to include a baby having basics like dining, dresses, security, transportation, and you can childcare. By firmly taking a lengthy get off out of works (or switch to area-date times) you’ll be able to face payday loans online Hawai the economic twice-whammy out-of coating this type of the fresh expenditures with the a living that’s quickly reduced.

Lovers which cannot seem to rescue the solution to advised 10%-of-your-earnings mark may want to book a consultation with an authorized financial planner, a professional taught to let subscribers lay monetary requirements. The brand new Economic Believed Relationship demonstrates to you certification and charges with the the web site. New CFA even offers 100 % free services with other finances information owing to its The united states Conserves program.

4th Week

It is time to measure the funds away from just how you’ll be able to buy the baby’s costs immediately following these are typically born, of course applicable, just how long you can take off out of works.

Make a buddy during the Time.

Rating the full briefing on maternity otherwise paternity advantages from person tips. Federal laws means you to render at the least 30 days see whenever requesting time away according to the Household members and you will Scientific Leave Work, and therefore entitles one the brand new mother who works well with a pals having no less than 50 professionals when planning on taking up to several weeks of delinquent, seniority-protected hop out.

Your boss need to pay plain old percentage of your own medical care benefits to your years. Together with one paid off make you possess, federal laws together with entitles birth mothers so you’re able to short-term disability shell out (typically 6 to 8 days) if its organization normally pays handicap positives various other facts.