Financial forbearance happens when the lender believes to lead you to briefly end while making your mortgage payments

Article Guidelines

You can request home financing forbearance contract for those who encounter good sudden pecuniary hardship, such as dropping your task or taking a serious pay slashed.

During the height of COVID-19 crisis, the government considering unique alternatives for home loan forbearance to greatly help as many people as possible stop dropping their houses. These options are still currently available, but some has ended given that the brand new pandemic will soon zero lengthened end up being an official county out of emergency.

Mortgage forbearance: What is it?

Financial forbearance is a contract between you and your home loan company or servicer so you’re able to briefly stop otherwise lower your home loan repayments and you may avoid foreclosures. Forbearance mode something similar to patience – the financial institution is showing determination during the get together the money you owe them.

Getting obvious, whether or not, forbearance isn’t really 100 % free currency otherwise financing forgiveness. This new skipped money have to be paid down later on – if not, your loan goes into standard, therefore you will clean out your property to help you foreclosure.

A forbearance arrangement is intended to help residents courtesy short term adversity, eg a sudden employment losses, absolute disaster otherwise expanded illness rather than paid down ill get-off.

Since of a lot Us citizens battled that have layoffs and disease because of the COVID-19 episode, government entities passed the newest Coronavirus Services, Save, and you will Economic Safety (CARES) Operate from inside the , and that compelled loan providers provide specific forbearance choices to consumers having federally supported mortgages. However, this part of the CARES Work expired when you look at the 2021. That does not mean forbearance happens to be off the dining table getting homeowners; it simply setting may possibly not end up being as simple to get into because try from inside the pandemic.

There was you to big exception toward conclusion regarding pandemic-related defenses: people having FHA fund. Brand new Government Property Administration (FHA) keeps expanded all of their COVID-19 loss mitigation options to every borrowers having FHA fund, whatever the cause for the financial hardship, and will continue such selection positioned up to .

While doing so, to own borrowers that are nonetheless battling financially to have grounds regarding new pandemic, the latest FHA will continue to render COVID-19-certain forbearance – make an effort to request it from the installment loan Pennsylvania , the authoritative big date the new COVID-19 national disaster usually prevent.

Just how financial forbearance performs

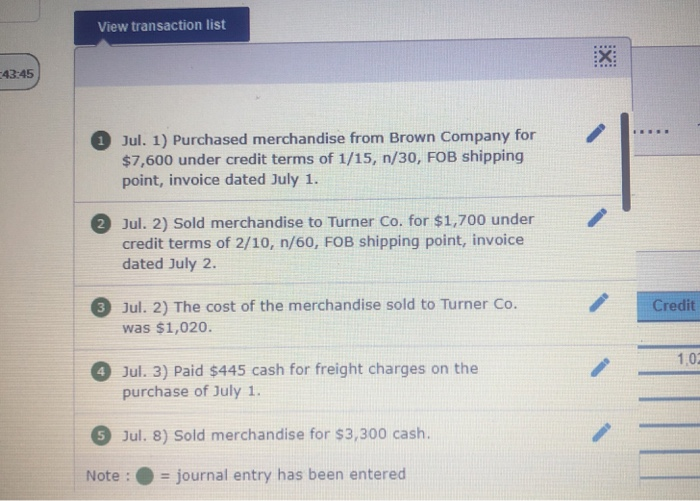

Just what all types of forbearance have in common is that it is possible to prevent making payments (or build shorter costs) for a particular period of time, but where they disagree is actually just how you can pay back those people missed money due to the fact forbearance several months comes to an end. You will find around three particular forbearance:

step 1. Reinstatement. You can avoid and come up with payments getting a-flat time and following, immediately following that point several months stops, you’ll be able to generate all those payments at once in the a lump contribution.

> Best if: Your financial hardship might have been solved at the end of the new forbearance several months and you may be able to pay-off the skipped repayments instantly.

2. Fees bundle. It is possible to build shorter repayments or no payments to have a set amount of your energy, right after which restart to make monthly payments. A fraction of the fresh new money your missed is actually placed into for every single payment per month before the full missed count was paid in complete.

step three. Commission deferral. It is possible to avoid and then make money to have a set time, following restart your normal mortgage payments. The quantity your debt inside overlooked money is born if the home is offered or even the mortgage was paid off and you may, in the meantime, would not sustain interest charge.

For these which have FHA funds, the You.S. Institution off Property and you can Urban Development (HUD) has the benefit of limited allege financing, that are attention-100 % free money familiar with shelter repayments missed throughout a good forbearance months. The borrowed funds need not be paid unless the house was offered or refinanced, or the brand new financial try otherwise paid off.