Should you decide borrow funds, your credit score may come on the gamble

Choice and unconventional property is gaining during the dominance. Regarding little homes so you’re able to environmentally-amicable property, strange property offer the possibility to individual a more affordable household, even in the event it is a little you to definitely. Residents try gravitating on the unconventional house for some grounds: these include less expensive to order and keep, shall be constructed on otherwise apply rims, and will be green, merely to identity several. not, they also have their downsides. A variety of households is rather smaller than a classic house. Besides are you presently loosing square footage having an unusual family, nonetheless it is hard to financing them.

Type of solution households

Lightweight homes are the thing that are involved for many individuals whenever they tune in to the term bizarre household. An everyday small residence is a dramatically smaller than your average household. Just like the a little residence is a fraction of a home, you can usually buy one getting a portion of the purchase price. You might have heard about a beneficial fixer upper, otherwise viewed some one flip one on television. Diy domestic systems and domestic renovations are becoming more common.

If you find yourself prepared to installed particular legwork, a fixer higher is the right option apply for MN installment loan online housing option for you.

For less than you’ll spend on a prepared-to-move-in home and a little perseverance, you could turn an excellent fixer top into the dream household. Ever heard off a modular household? It solution houses option is a house that is manufactured in parts in to the a plant, in the place of a created family, that is built on site. Per section of a standard house passes through a factory, that will be featured to own quality control along the way. As soon as your standard residence is done, it is taken to your home webpages or parcel, where experts create a foundation and then lay the house off towards the top of they. After that, builders otherwise contractors make the finishing touches and it is ready to have move around in. An eco-friendly home is as well as believed an alternative house, and it also doesn’t have to be a giant family secured in the solar panel systems and you will costly eco-friendly tech. Of many smaller and you may little home can be produced eco-amicable, and may also feel totally running on solar otherwise snap powermon eco-friendly features is solar panels, composting toilets, and you can rainwater harvesting and purification systems, bloating tanks, programable thermostats, and effort efficient appliances. Certain innovative homeowners was actually renovating RVs and you can busses on households. The benefit of having an enthusiastic Rv otherwise bus tiny household would be the fact it is currently to the rims – thus, you might bring your house or apartment with you everywhere you go. At under the expense of a house, you might transfer an Rv otherwise shuttle with the a cozy nothing household.

Financial support the strange family

Even in the event the bizarre home can be smaller compared to a classic home, you’ll still have to figure out how far house you could potentially afford. You will need to envision several things after you referring so you’re able to money the option home:

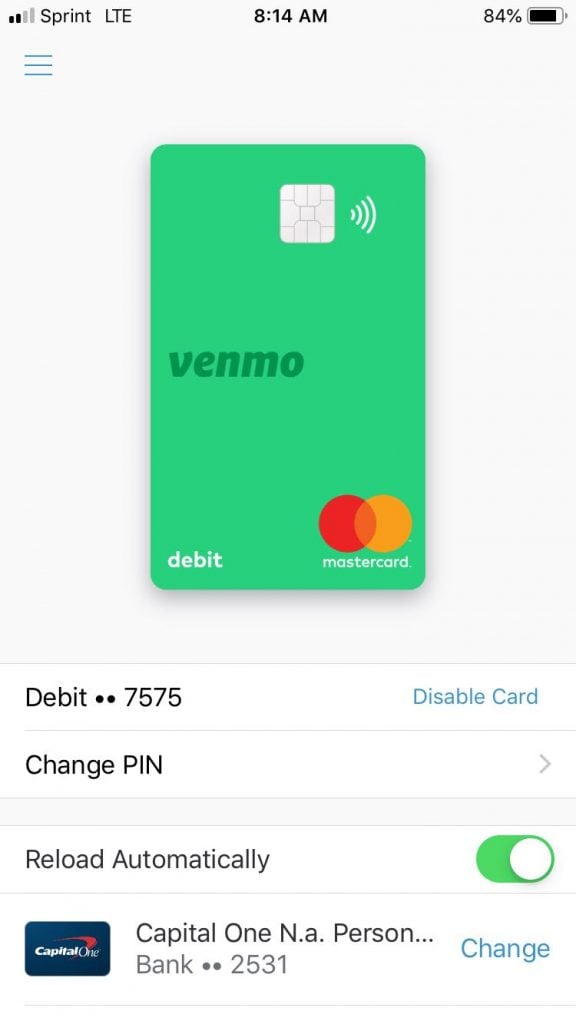

Your credit rating is essential. Display screen your credit score to make sure that its in which it must getting as you prepare to take out a loan.

Exactly how much really works do you perform oneself? Using time and you may labor will save you a great deal of money. Are you presently able to do the development in place of employing an excellent builder? The greater number of you can do on your own, the greater possible probably save your self.

Tend to your home qualify for a mortgage? Do some research. If you cannot get home financing, think an enthusiastic Rv otherwise auto financing. Think about your own deals? Have you got sufficient to funds the alternative house instead good loan?

A restoration loan is an excellent choice if you need a great fixer top, and might assist change an old family to the house off their aspirations. Each various other financing options has its own debtor official certification and requirements, thus chat to your mortgage banker on what is effectively for you as well as your house. You will find some different home mortgage choices for fixer uppers.

You might remember little home financing similar to this: whether it features a foundation, you can probably score home financing for it. However, many loan providers provides the absolute minimum loan amount. Instance, can you imagine the lender’s lowest loan amount to possess home financing is actually $fifty,000. That implies should your smaller residence is below $50,000, your home won’t be considered, incase it is $50,000 or even more, it does. Sadly, little houses possibly dont see you to lowest, and you will must financing your nontraditional home another way. Getting small properties that do qualify, there are many different home mortgage option for borrowers in different monetary points.

A similar thing relates to that loan to suit your standard home. Because your standard household could be fixed (towards the a charity), it may qualify for an interest rate. Once more, consult your home loan company and discuss the funding alternatives.

Funding getting choice properties that may move is a bit more. Strange belongings for the wheels is commonly funded compliment of vehicles otherwise Rv fund. A keen Camper loan are used for RVs, trailers, travelers, and lots of almost every other leisure car (instance ships). Car loans was another type of you can easily solution if for example the unconventional house is drive-in a position. For each and every bank and you may bank differs in what and you will whom qualifies, therefore do your homework and talk to an expert.

Choice home are receiving ever more popular. Whether you are seeking downsize and you may explain or buy your very first household, an option household will be the best option for your.