3.dos Winnings enhanced because of the large interest levels, as financial business face bumpy prospects

Rising appeal margins assisted improve profitability out of euro city banking companies for the 2022, particularly in regions having considerable amounts from variable-rate lending. The newest aggregate go back to the guarantee (ROE) away from euro urban area tall establishments (SIs) rose by the 1 payment area last year in order to eight.6%. Alternatively that have 2021, whenever a decrease in mortgage losses terms is a portion of the foundation trailing improving profitability, the advance during the 2022 is actually mostly driven of the higher core revenues (Graph 3.5, panel an excellent). Desire margins increased on the rear of your own big upsurge in policy rates beginning in the summer months of just last year, while banks adjusted the put prices slowly. Margin expansion tended to feel large in those countries with a great big display away from funds granted during the changeable rates, however, other variables and played a job, such as for example banks’ hedging behavior additionally the interest rate profile additional the new financial publication. As well, lending quantities made an optimistic contribution to growth in websites desire earnings (NII) in the most common nations inside the basic three quarters of last year (Graph step 3.5, panel b, right chart). On the other hand, NII flower https://availableloan.net/loans/tax-refund-emergency-loans faster highly within the nations like France where fixed-rates credit predominates and you will banks had currently improved deposit cost so you can more substantial extent. Online payment and commission income (NFCI) along with improved, even in the event within a more sluggish price than in 2021, when you find yourself expenses proceeded to go up (Graph step 3.5, committee b, leftover chart). Basic quarter 2023 income outcomes for indexed finance companies advise that even after down trade money and higher will set you back, profits improved further on the back from highest NII.

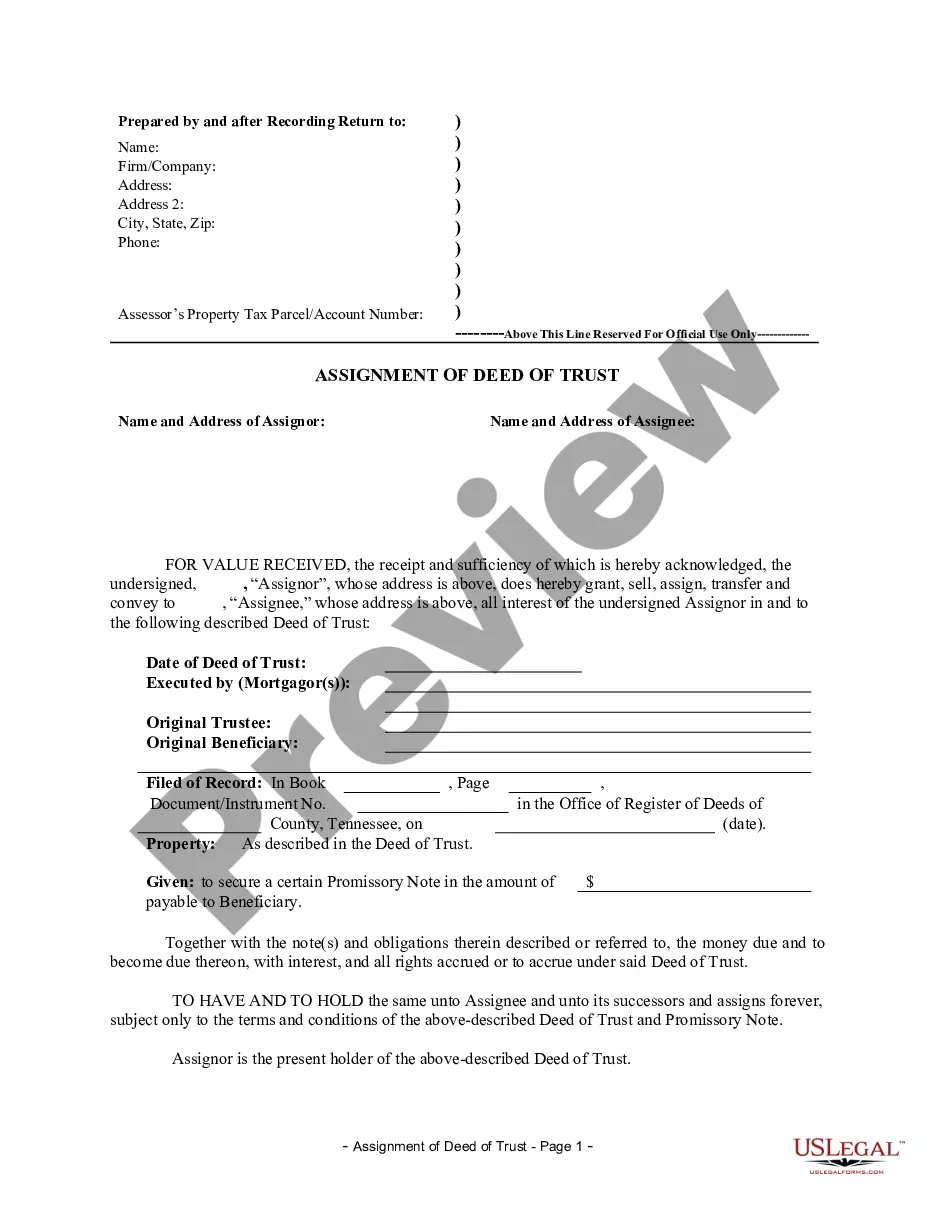

Graph 3.5

Financial earnings improved subsequent during the 2022 on the rear out-of more powerful websites desire income inspired by the highest margins, particularly in places which have changeable rates of interest

Sources: ECB and you may ECB data.Notes: centered on a balanced take to regarding 83 euro urban area extreme organizations. Panel b: the fresh new share from lending on variable rates lies in the fresh new company amounts and you may identifies lending that have a varying interest and you may mortgage loan fixation chronilogical age of around one year. NII means web desire income; NFCI is short for web fee and you may commission earnings.

Inspite of the banking business be concerned in the ics, industry experts assume euro urban area financial profitability to improve further in the 2023. Market hopes of the future aggregate ROE regarding listed euro town finance companies to own 2023 was indeed revised right up sizeably as begin in the season, which have ROE forecasts growing regarding 8.1% to nine.2% amongst the prevent out-of just last year therefore the beginning of February (Graph step three.six, panel good). Much of which upgrade is actually driven from the large requested NII within the an atmosphere where interest projections was changed to stay higher for longer, more than offsetting the possibility effect away from stronger borrowing requirements and understated financing gains. Hopes of lower problems portray a second extremely important confident foundation, reflecting an improvement on the euro city macroeconomic mind-set due to the fact beginning of the this present year. The new compression inside banks’ industry valuations into the February and better bank financial support will cost you don’t seem to weigh towards the financial profitability because the ROE requirement improved subsequent to help you 10.6% at the end of May. The excess up updates off ROE standards given that March are attributed primarily to better NII, combined with keep costs down, higher NFCI and lower problems. Lender analysts may well update their ROE projections off going forward, offered considerably firmer financial financing conditions, a great slump inside the mortgage demand and a lot more muted credit dynamics to have NFCs particularly because of this (Graph step 3.six, panel b).

Chart step three.6

ROE forecasts having 2023 had been changed up highly this season, despite tighter borrowing from the bank criteria and you can simple development in credit so you can NFCs particularly