Normally two both get basic homebuyers has?

- Very first Home owners Give Guide

- Fhog Vic

Very first Resident Grant VIC Calculator

The First Homeowners Grant (FHOG) calculator is designed to exercise and this regulators benefits particularly grants and stamp responsibility exemptions that you may qualify for.

When you find yourself entitled to the newest FHOG VIC, Mortgage Pros can help you sign up for brand new FHOG and during your to find techniques. E mail us on 1300 889 743 or ask on the internet to speak to just one your pro lenders.

FHOG To possess Regional Victoria 2021

Brand new $20,000 regional First Homeowner Grant ended for the . Yet not, it’s still available on deals registered with the out of . It indicates the fresh new Victorian Bodies often still offer an effective $20,000 offer to those earliest home buyers buying or building the brand new attributes into the regional Victoria up to the worth of $750,000.

If you registered into the an agreement to order otherwise generate a beneficial brand new home inside the regional Victoria after , you may be entitled to new $10,000 FHOG.

Basic Homeowners Give VIC Eligibility

Getting eligible for the original People Offer inside VIC, you will find several guidelines you need to follow, which can be:

- You must not possess had property and other property in australia, sometimes as one otherwise . not, you might still be eligible for the latest FHOG for those who or your lady/companion purchased possessions with the otherwise after but i have not stayed around as your family.

- You ought to are now living in your house for at least one year inside 12 months away from purchasing the house or property or from the time your house is actually fully built. Defence workers are excused from this abode requirements.

- You need to be old 18 or over and get often an Australian citizen otherwise permanent citizen by the time you accept or in the event the house is willing to feel filled.

- You must incorporate given that a single and not as the a pals otherwise a count on.

Sadly, zero. Even although you and your partner/partner try both qualified, singular people could well be offered the first homebuyers grant.

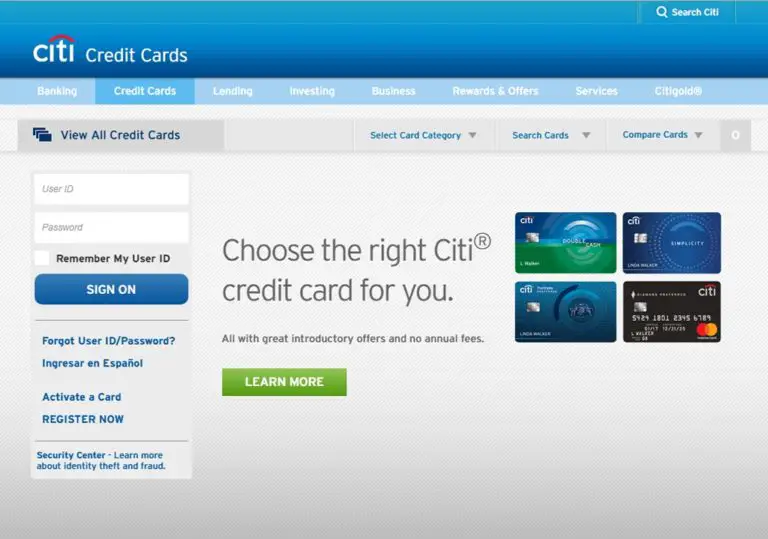

Ideas on how to Make an application for Very first Homeowner Grant VIC

In nearly all instances, the bank or bank that you’re having the mortgage regarding have a tendency to resorts the original Homeowners Grant (FHOG) app on your behalf. Lenders act as a medication representative on the part of the official authorities and will techniques the new commission of offer along with your loan funds.

For people who need the offer getting settlement otherwise basic drawdown/advances fee, however, you ought to hotel the job that have an approved representative.

You could just resorts your application actually on County Revenue Work environment (SRO) Victoria in the event that an approved agent isnt hotels the newest FHOG software function on your behalf. In such instances, it is recommended that you use thanks to good solicitor/conveyancer.

When doing very, your or their solicitor have to send the fresh new SRO the original application means, hence must be installed, published and completed in bluish or black ink, including duplicates of your own help data. Applications cannot be lodged with the SRO until adopting the completion of your https://speedycashloan.net/personal-loans-ne/ own eligible deal.

Mortgage Masters has actually aided tens of thousands of earliest homebuyers pertain towards the FHOG and purchase the very first household. To help you clarify so it cutting-edge techniques, talk to one of the specialist mortgage brokers of the contacting you with the 1300 889 743 or ask on the internet.

Perform Earliest Home buyers Shell out Stamp Duty In Victoria?

Stamp responsibility concessions are around for very first residents inside Victoria if you buy a reliable domestic or a freshly based household.

So long as the home is appreciated less than $600,000, very first home buyers when you look at the Victoria don’t shell out stamp obligations whatsoever. For individuals who pay ranging from $600,000 and you may $750,000 for your earliest house, your p obligations.

Note: To get entitled to stamp duty exemptions otherwise concessions, you truly need to have entered on an agreement out-of sales to purchase very first household to the or immediately after .

The brand new Victorian Homebuyer Funds, that is budgeted at $five hundred million, are a discussed equity plan which allows eligible basic homebuyers to purchase a house inside the Victoria with in initial deposit given that reduced because 5%.

The brand new Victorian regulators usually lead doing twenty-five% of purchase price, while, earliest home buyers will be able to pull out financing that is value 70% of the property really worth. However, government entities should keep their stake on your property if you do not sell it otherwise purchase from nation’s show.

The fresh caveat is the fact, due to the fact authorities possesses twenty five%, in case the property’s valuation increases in order to $500,000 for the 5 years, you’re going to have to shell out $125,000 to order back brand new twenty-five% in the authorities.

- Youre an enthusiastic Australian resident otherwise permanent citizen

- Youre about 18 yrs old during the time of payment

- You have spared in initial deposit of at least 5%.

When Does The original Homeowners Give Get money from inside the VIC?

Within the Victoria, the new date the give try repaid depends on whether you’re building or to find the brand new and regardless if you are using by way of an approved broker (their funds merchant) otherwise yourself.

Whenever you are accommodations the FHOG application directly on County Revenue Workplace, up coming applications are thought only immediately following payment otherwise pursuing the Certificate away from Occupancy could have been issued. Percentage was produced inside 14 days out of lodging the application.

To purchase a first house will likely be a challenging techniques. If you are looking to buy your basic house in the Victoria or somewhere else in australia, we’ve your protected.

We written a home buyers way one to breaks down this new complex home buying processes for the simple actions you to definitely seek to assist fulfil first home buyers’ think of homeownership.