The initial way is to expend the vendor into the new household upfront in the cash

The manner in which you pay for your future family matters particularly when you might be of retirement age. After all, housing costs are often the basic- or next-biggest costs getting homes inside senior years. Hence, the way you pay money for your future household can be dramatically alter how profitable and you can fun retirement years shall be. Up second, find out how a property Collateral Conversion process Home loan for sale financing can give you assurance and you will financial stability in the old-age including very little else.

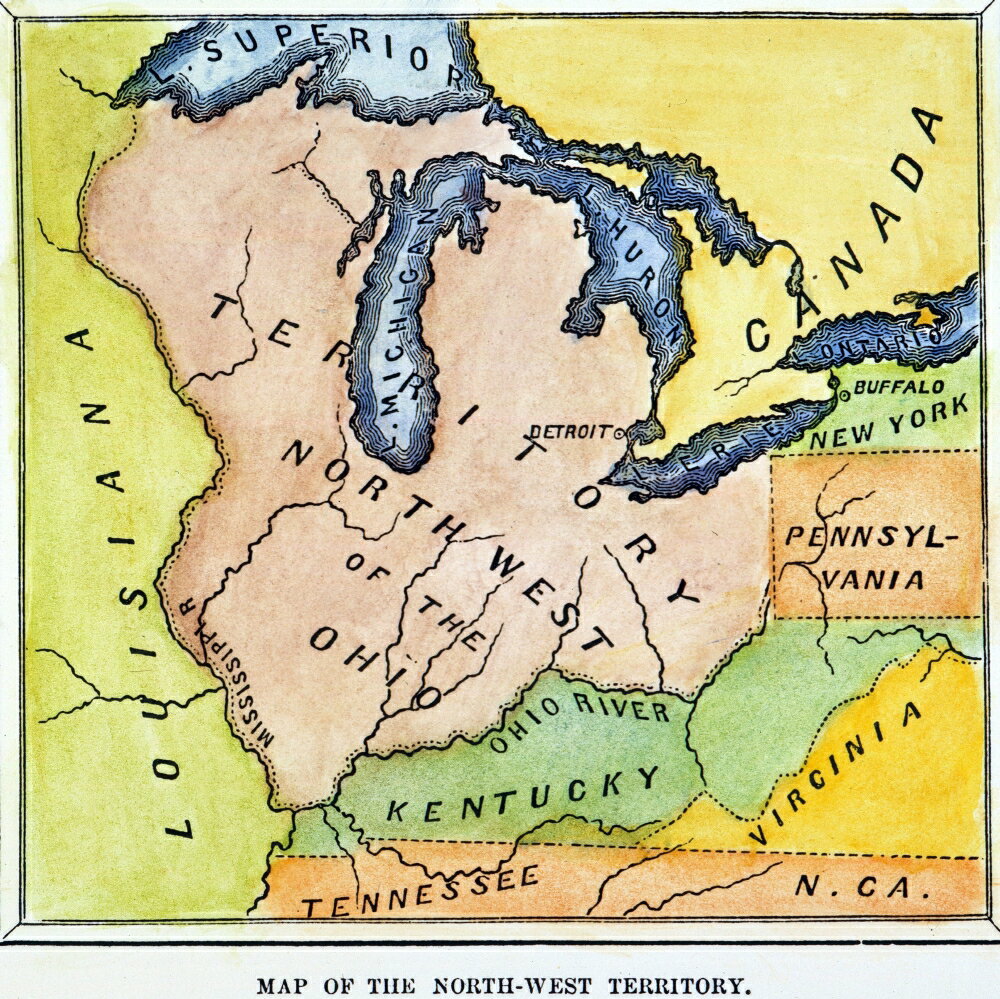

Basically, it is a reverse mortgage which enables elderly people many years 62 otherwise old to order an alternative number one household that have mortgage proceeds from the reverse financial. This sort of loan started regarding property collateral financing the home Guarantee Sales Mortgage (HECM) that authorities install exclusively for the elderly and you can passed toward rules inside the 1988. 2 decades later, the new HECM loan extra a different sort of variation you to provided elderly residents an identical benefits of the traditional HECM opposite mortgage however, additional the option to order a different sort of household. It mortgage is named the home Collateral Transformation Mortgage to buy. And it is the main focus regarding the article.

New Backstory

Depending on the Federal Connection out of Realtors, very homebuyers was financial support their new family orders regardless of if it try 65 otherwise old. Now, most retiree homeowners are employing traditional money to invest for their new house. As well, over forty% from retirement age property owners are nevertheless holding mortgage loans. One to number keeps indeed improved in the last several as well as effect on home prices and you will old-age portfolios.

A better way

Let’s say what you once thought you realized about possessing good old age domestic is completely wrong? Just how in the future do you really wish to know in the the perfect solution is? This services may help include the other assets and build a great most useful lifetime on how to savor. Extremely the elderly thinking of buying a house are only alert to both traditional an effective way to pay for it. Next and well-known way is to get an effective traditional home loan while making monthly payments until you pay the financing back to full.

But not, for more than a decade, there has been an alternative choice offered to homebuyers about 62 otherwise elderly. That one allows https://paydayloancolorado.net/hot-sulphur-springs/ them to make a huge one-time down payment according to their age and current interest rates not result in a month-to-month dominant and you may interest payment later on. Linked the fresh new dots yet ,? That it last and a lot more tempting method is the home Security Conversion process Mortgage to buy.

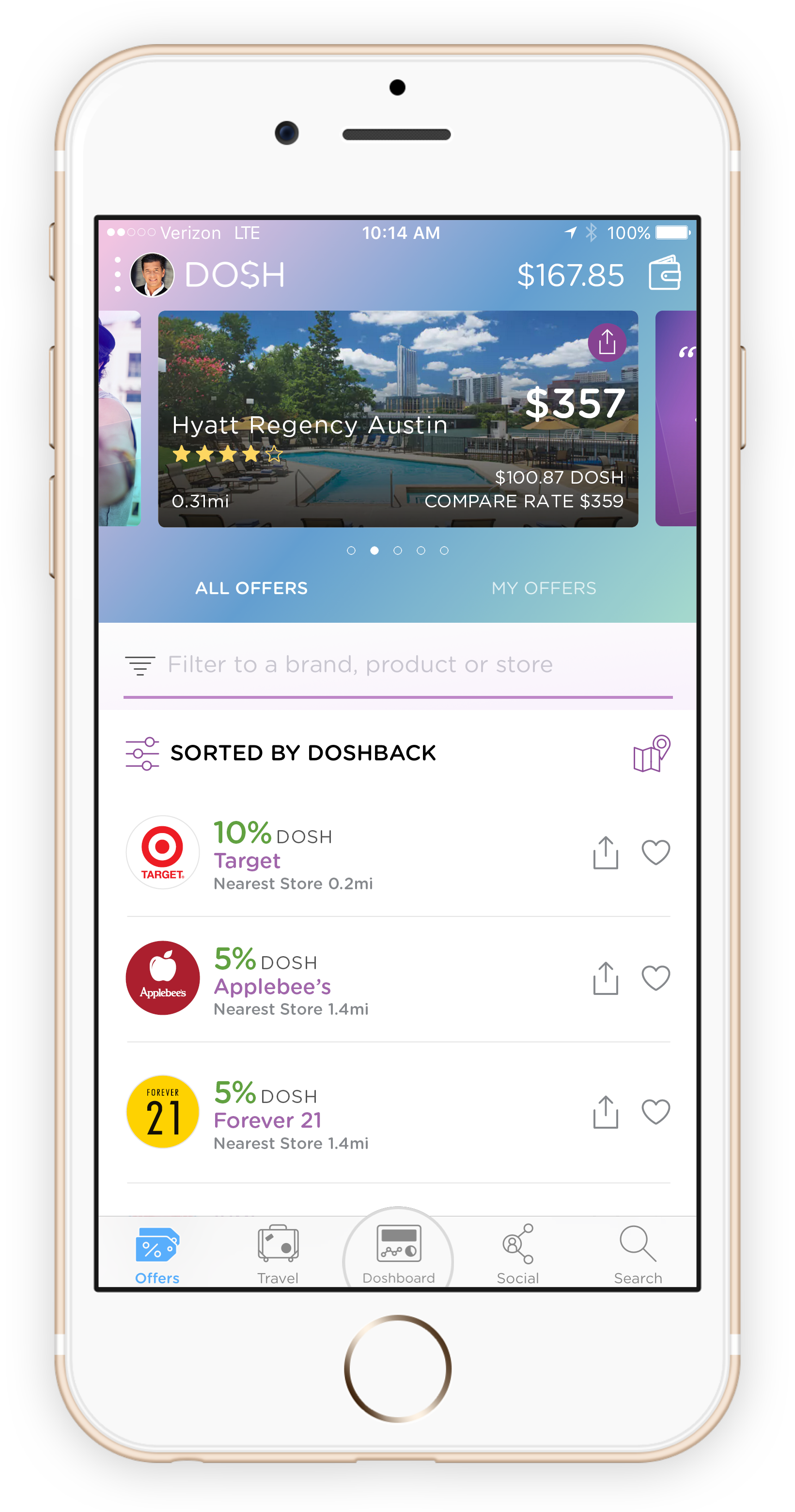

The house Collateral Conversion Mortgage for sale brings together a knowledgeable features of one’s first two alternatives. It also creates more liquidity and you can eliminates even more month-to-month cash move requirement for a monthly mortgage repayment. Youre nevertheless required to build your normal possessions charge payments (possessions fees, homeowners insurance and you can any HOA charge), as if you’d put among the many other choices. However, to make a main and appeal fee is starting to become recommended. In place of this duty, you’ll be able to save your self a pile of cash each month and you can delight in more economic independence than in the past.

The latest Link

Now that you realize about the house Equity Sales Financial to own Buy financing, are contacting a financial coach. This person is also work with the brand new numbers on all of the around three home buy selection to see which is right for you. In addition it is wise for the coach otherwise CPA so you’re able to go through the income tax considered possibilities this particular loan will make to you personally otherwise the heirs. Including, highest you to definitely-big date focus write-offs might possibly be offered whenever paying down some otherwise all loan.

To acquire you to brand new home is all about a whole lot more than the financial edge of it. Its in which you waste time that have household members events. Otherwise viewing one the grandchild. It can be in which you host family relations to have products and you will vacations. Or possibly simple fact is that put you take care of anyone you love. These represent the main some thing in daily life, and achieving more cash freed around let purchase them will assist you to appreciate them towards more substantial level.

To find out more on the contrary mortgages, excite contact us during the Fairway of Carolinas. And, read through this blog post, and that dispels a number of the myths are not for the contrary finance.