How to Submit an application for a beneficial Huntington Bank Personal bank loan?

Customizable Terminology. Huntington Financial will bring personalized loan terminology that may be designed to help you fit individual monetary situations, making it possible for individuals discover a payment package that fits the funds.

Online Membership Government. Consumers can also be easily would its personal bank loan membership on the internet, providing them to check balances, song deals, while making payments effortlessly.

Immediate access so you’re able to Money. Huntington Financial also provides fast access in order to loans, allowing borrowers to get their funds timely and employ it to own their designed objectives.

Qualifications Criteria. Like any lender, Huntington Financial enjoys certain eligibility requirements private finance, and not all of the people ount or conditions.

Security Requirements. Secured finance from Huntington Financial require collateral, meaning look at this now consumers need to promise possessions given that safety. This may not be possible for folk that will restrict borrowing selection.

Creditworthiness Considerations. Creditworthiness takes on a serious part within the loan recognition and rates of interest. Individuals with less-than-primary borrowing histories will get deal with pressures in protecting good mortgage terms or possibly provided highest rates of interest.

Minimal Supply. Huntington Bank’s signature loans are just in eleven says in which the financial institution already keeps a visibility: Kansas, Illinois, Indiana, Kentucky, Michigan, Pennsylvania, Western Virginia, Wisconsin, Minnesota, South Dakota, and you can Texas. It limited accessibility could possibly get limitation supply for possible consumers residing external these types of states.

To ensure a flaccid software techniques for an unsecured loan, it is best to check out the required data files in advance. You may contact the lending cardio within +1 (800) 628-7076 otherwise reach out to neighborhood department for individualized advice into certain files you’ll need for your application.

Requirements

- Personal Cover or Taxpayer Personality Count. That it identification is important for guaranteeing your name and you can complying which have regulating criteria.

- Personal identity. Appropriate character data files, particularly a driver’s license or passport, might be necessary to present the label.

- Money suggestions. Documents showing your revenue, for example spend stubs, tax statements, otherwise financial statements, are expected to assess your financial ability to pay-off the newest financing.

- A job history. Information on their employment history, as well as your employer’s name, job standing, and you can lifetime of a career, are typically questioned to test the balances and you can capability to fulfill payment financial obligation.

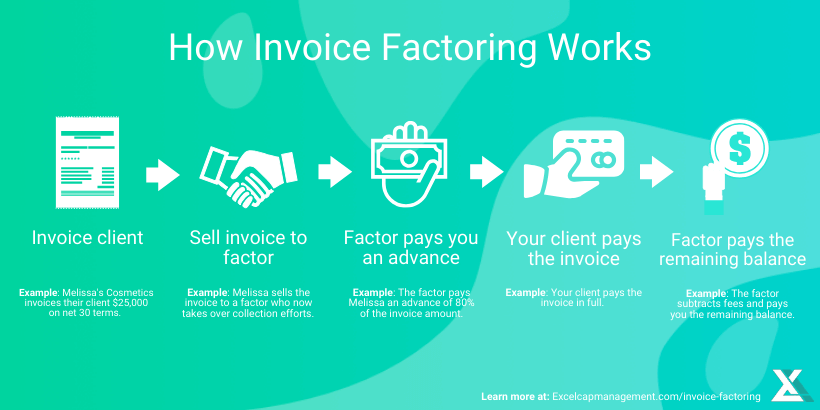

Ways to Get the Currency

After Huntington Bank approves your loan application, the financial institution have a tendency to normally disburse the mortgage amount to your by way of an approach to the decision. Here you will find the common methods Huntington Financial ount.

Head Put. Huntington Lender is also import the loan funds directly into your own designated family savings. This process also offers convenience and you can allows quick access to the fund.

Glance at. The financial institution ount, and is shipped into entered target. You’ll be able to put or dollars the brand new glance at depending on your own taste.

Transfer to Huntington Savings account. If you have a preexisting Huntington Family savings, the borrowed funds funds will be transmitted directly into one membership.

How-to Repay good Huntington Bank Unsecured loan?

Once your unsecured loan application is accepted, you are supplied a lump sum. Next, you will pay off the loan more a specified period due to consistent fixed money and you will a fixed interest rate.

Points to consider

- Mortgage Words. Huntington Lender supplies the autonomy away from around three- otherwise four-seasons terminology for their signature loans, enabling consumers to select the fees several months that meets their requirements.

- Charges. Take advantage of the benefit of no software otherwise prepayment costs when acquiring a consumer loan from Huntington Bank. It assures a transparent borrowing experience with no even more charges.

- Limited Access. It is important to observe that Huntington Bank’s personal loans are currently limited in the eleven claims where in actuality the financial keeps a presence: Kansas, Illinois, Indiana, Kentucky, Michigan, Pennsylvania, Western Virginia, Wisconsin, Minnesota, Southern area Dakota, and you can Colorado. It geographical limit could possibly get restriction availableness for folks residing beyond these types of says.